2026 Outlook: Predictions, Reflections, and Lunch with a $3 Trillion Giant

This year started with an annual tradition: reviewing our internal stock picks and predictions from 2025 and making new ones for 2026, with our founder, Brian. It is always collaborative, a bit contentious, and filled with healthy debate. I love that it helps us strengthen our convictions, as everyone brings a different viewpoint to the table.

Renee and I also had the distinct pleasure of having lunch with eight other advisors and some of Capital Group’s leaders last Tuesday in Roseville. Mike Gitlin (CEO) and Martin Romo (CIO) were in town to pitch the CalPERS investment committee on hiring their firm.

American Funds/Capital Group has been in business for nearly 100 years and now manages over $3 Trillion in assets—nearly 20% of all actively managed dollars. It was an immediate "yes" when we got the invite.

The 75 minutes flew by as we discussed their convictions and concerns on the economy, AI, Small-Cap vs. Large-Cap, private equity, interest rates, and more.

So, what’s (maybe) next? Here are 5 thoughts on the market.

1. Civil Old Sobering

(P.S. That title is an anagram for Gold, Silver, Bitcoin)

The "Store of Value" bros got wrecked last month after a months-long bull market in metals and crypto collapsed.

Bitcoin has now dropped 25% (or more) seven times since 2020. Silver spent years in a 30% drawdown before a biblical run in 2024-2025 (up 300%), only to drop 30% on Friday alone. Gold is roughly 10% off its high, trading back under $5k an ounce.

You can call crypto whatever you want, but maybe "store of value" is a term we should retire.

Looking ahead, you can make an argument for Gold to roughly keep within 20% of the S&P 500’s value. Both are projected to hit the 10,000 level by the end of the decade, per strategist Ed Yardeni. His argument? A bipartisan commitment to keeping the money printer going. That seems reasonable.

Of course, this isn’t a solicitation for gold in your portfolio. We always have a strong bias towards cash-flowing assets like equities and bonds.

2. Gridlock and The Great Infrastructure Buildout

Former Google CEO Eric Schmidt recently noted, "We need the energy in all forms, renewable, non-renewable, whatever. It needs to be there, and it needs to be there quickly."

He projected that 67 more gigawatts will be needed by 2030. That’s enough to power over 50 million homes. Our world needs more electricity. Our current infrastructure and energy grid cannot provide what we will need. Upgrades are needed, and quickly.

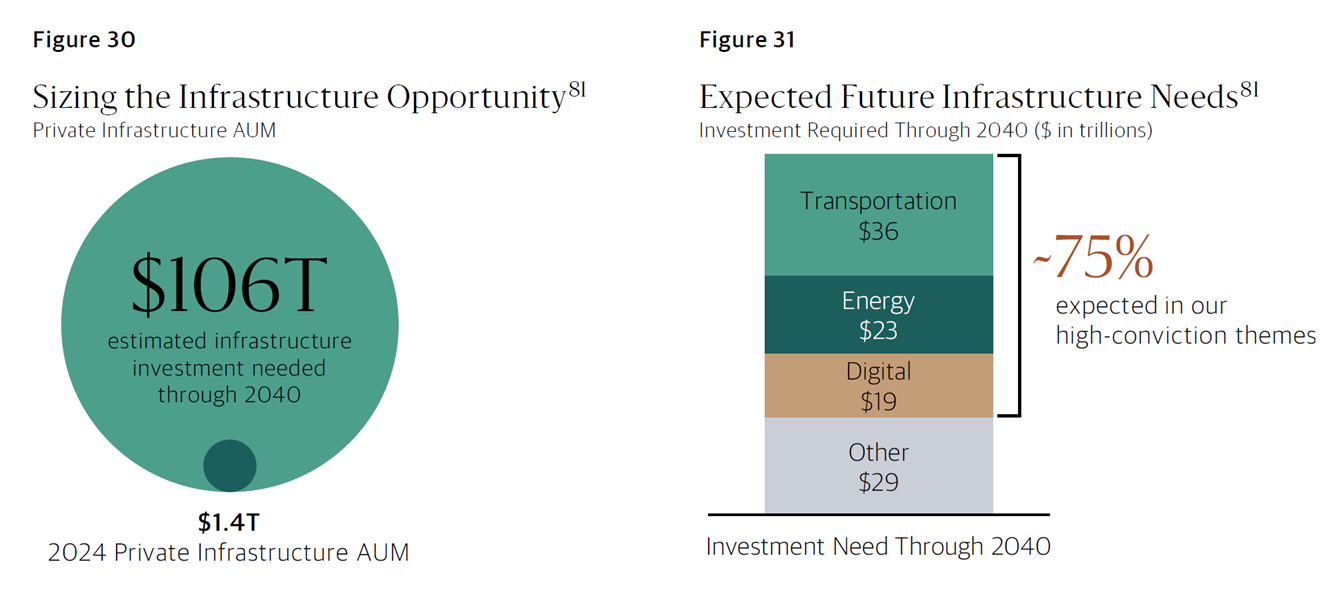

Blackstone estimated the opportunity in the graphic below:

Martin Romo pointed out during our lunch that electricity is at the very base of the AI pyramid. New data centers can’t run without it, and chip companies can’t keep selling chips for data centers that aren’t built. Power generation and distribution have several tailwinds and should be a major theme in investment markets.

3. Winners and Losers Will Emerge in AI

This prediction is a bit like saying the sun will come up tomorrow or that clowns are terrifying.

However, you are starting to see companies tied to OpenAI (ChatGPT’s parent) get crushed relative to Google’s Gemini. Microsoft, CoreWeave, and Oracle are some of the most closely tied to OpenAI’s finances. The market is starting to wise up to a couple of things:

OpenAI’s Sam Altman consistently lies whenever he can about his ownership, benefits, and product capabilities.

A business that spends $3 for every $1 in revenue is not a great business (yet).

AI is transformational and disruptive—that is all true. It is also expensive to build. The problem is that eventually, investors get tired of asking when the earnings will arrive. That’s when enthusiasm wanes, and share prices trade sideways or down while the underlying company works towards profitability. I think that is exactly what is happening with a handful of these AI-powered darlings.

4. Lowering the Benchmark

Unemployment is creeping higher and inflation has slowed. That means one thing: Short-term rates are probably going down.

We’re guessing the Fed Funds rate will drop a full 1% through 2026.

Yes, it will probably be politicized. It will also be needed. Amazon cut 30,000 corporate jobs in the last 6 months, citing "AI efficiencies," and there are over half a million layoffs projected in 2026 alone. The Fed has a dual mandate: Price Stability (inflation) and Employment (fuller is better). Cutting rates can help spur the economy and job market.

That means money markets and CDs will probably pay less soon. It might be a good time to extend maturities and lock in these 3.5% rates (in CDs and Treasuries) while we still can.

5. The Forcep Awakens

Healthcare stocks have trailed other sectors, averaging 4% annually going back to 2022. United Healthcare's stock just got crushed when reimbursement rates didn’t increase for 2026.

But one thing we know is that a lot is happening out there. Biotech companies continue to invest in innovative new treatments daily, with several using a combination of AI research and CRISPR technology to find solutions. (You can read more about 2025’s breakthroughs HERE.)

The healthcare sector, in general, is trading at a below-market average (Forward P/E of 19.9). While insurers (and Ozempic) make up the majority of headlines, new cures and treatments are dominating the inner pages. Healthcare stocks are overdue for some market love.

Nobody knows what the future will hold, but

With developments in AI, labor markets, global power demand and populist politics, these next few years should be very interesting 😊