Some Guesses for 2026

Read MoreAs all parents of siblings know, there comes a time when the firstborn stops seeing the second child as ‘cute’ and instead views them as a threat. Internet 1.0 companies are acting similar. ChatGPT was fun in its infancy, but this year it turns 4 years old.

Read MoreGiving a 7-year-old $800 a month doesn’t seem like a great idea (he’d convert it all to Roblox in-game money, I’m certain). Instead, we directed it to their investment (taxable brokerage) accounts:

Read MoreEvery year, the government sets new rules for how much money you can save or gift in special accounts. Here are the most important numbers for 2025:

Read MoreThe concept is simple: Invest your money to not only grow your wealth but also to support companies that are making a positive impact on the world. Can your portfolio really align with your values?

Read MoreHow long can this melt-up in AI/Quantum/Cloud stock valuations continue?

Read MoreSo you want to be a Doomsday Prophet like Dent, Schiff, Roubini or Rickards. Here’s How to do it:

Read MoreSome of the new tax policies take effect in the 2025 tax year, others in the 2026 tax years. This letter exists to inform you of the most relevant stuff taking effect in 2025.

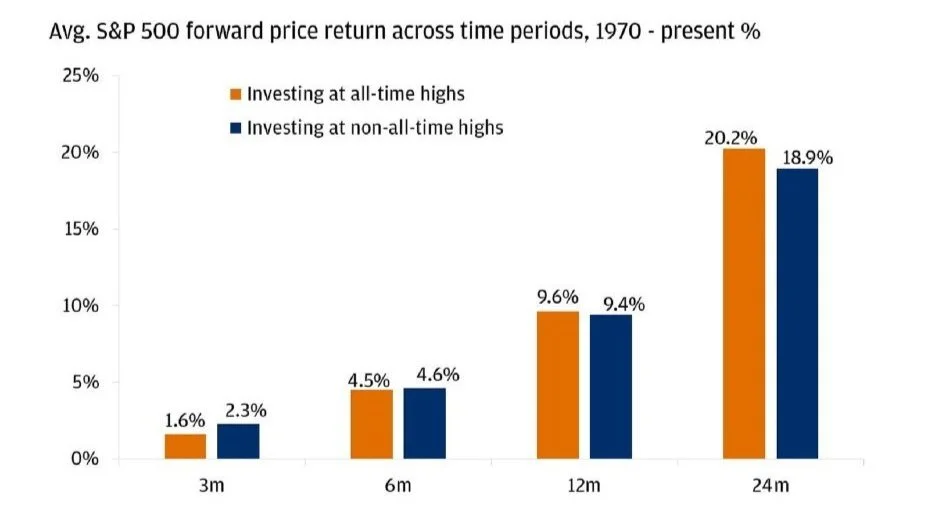

Read MoreWhen you read “stock market at all-time highs”, you probably expect a crash to follow shortly after. I’m not sure that’s something to worry about:

Read MoreThe “One Big Beautiful Bill” passed last week, and was nearly 900 pages long. It’s packed with new legislation and changes to the tax code. Here’s what stands out:

Read MoreBut our society, our standard of living, has improved dramatically! Progress is an underappreciated piece of our story. Consider the following:

Read MoreIt’s no secret, California has earned its reputation for an expensive place to live.

Taxes can be a confusing and complicated issue, even more so when we live under 2 tax codes: CA State and Federal.

Read MoreThink of it this way: with a traditional IRA, you get a tax break now. With a Roth IRA, you get a tax break later. And that "later" tax break can be a very big deal:

Read MoreAmodei believes the AI tools that Anthropic and other companies are racing to build could eliminate half of entry-level, white-collar jobs and spike unemployment to as much as 20% in the next one to five years

Read MoreJust as a few cool days don't stop summer from arriving, market dips don't cancel the potential for long-term growth.

Read MoreMost people don’t know that CD’s are available through investment companies- often with better rates and terms than banks can offer. Here’s what you should know:

Read More