What Happens After Investing at All Time Highs?

After rallying 20% in 2023 and 2024, the U.S. stock market has again reached all-time highs. When you read “stock market at all-time highs”, you probably expect a crash to follow shortly after. We’ve all had the rug pulled out from us at one time or another, and that’s a memory that sticks.

However, stocks at ATH’s are not (on their own) something to worry about:

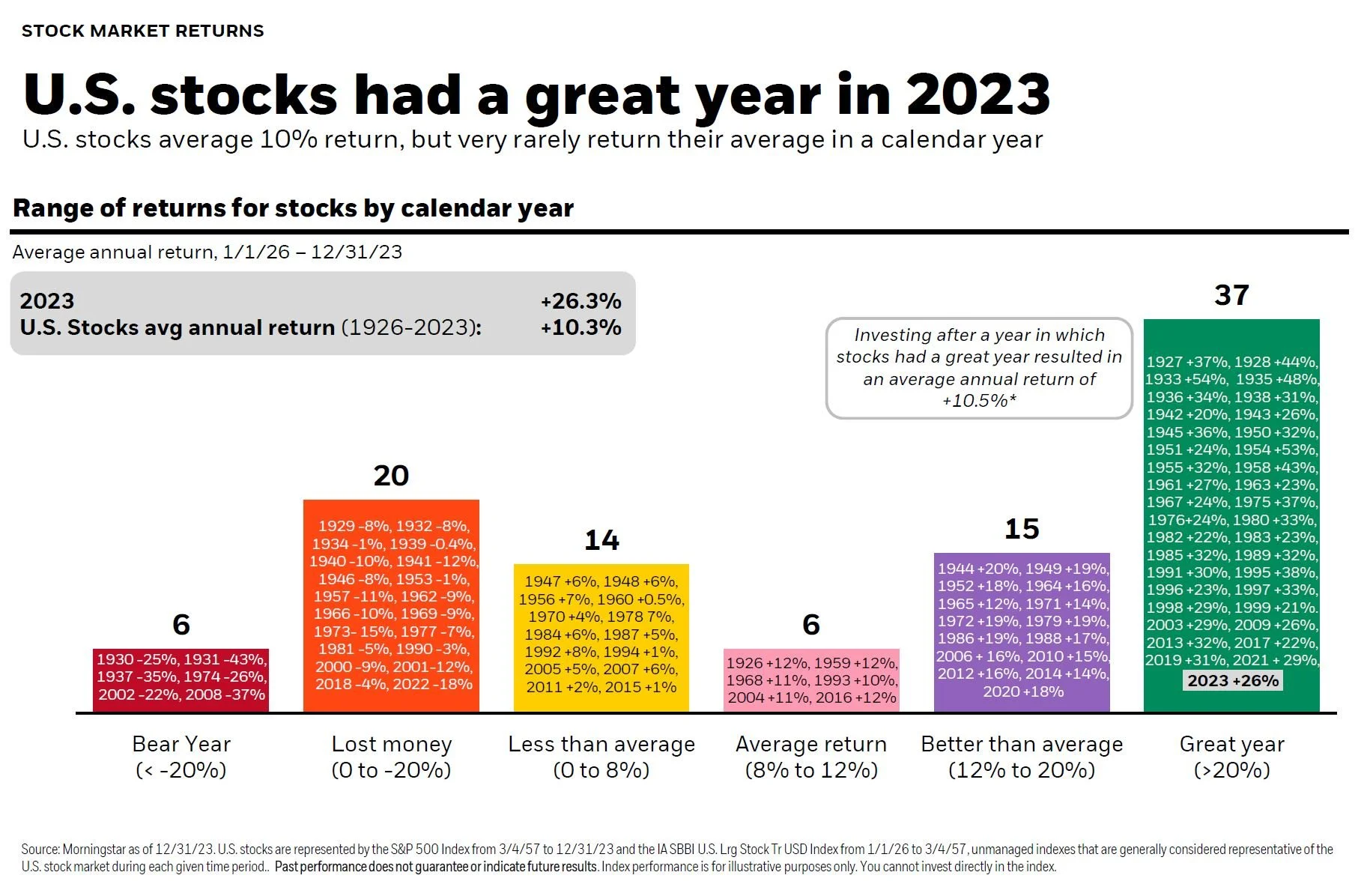

History suggests that after a 20% surge, the market's next move is often...up. Of the 34 times the S&P 500 gained 20% or more, 22 of the following years saw positive returns, averaging +8.9%.

All-time highs are more common than you’d think: the S&P 500 has historically spent nearly 5% of its trading days making new all-time highs. That’s more than once a month!

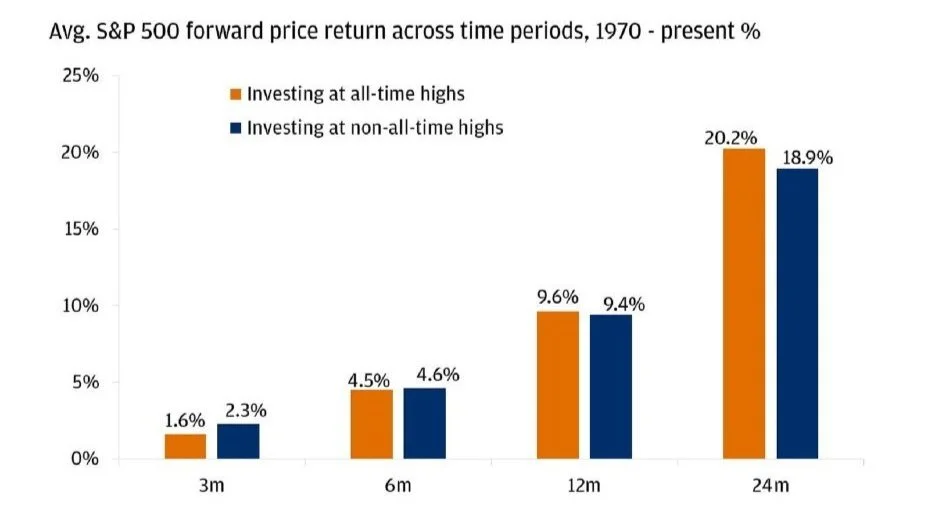

JP Morgan did some research and found that all-time highs tend to be better days to invest than the “average” day. Why? One explanation might be that positive momentum is a difficult thing to derail.

Finally, it’s worth considering how the market grows. After all, companies continue to strive for more profits year after year. Coupled with inflation, the index has shown significant compounding of earnings over the past decade.

With that in mind, here’s the (kind of stale, but still tasty) chart of nearly 100 years of market returns…

If you’ve got questions, you can book a free call or appointment here: