AI Turns 4, Software Stocks Throw a Tantrum

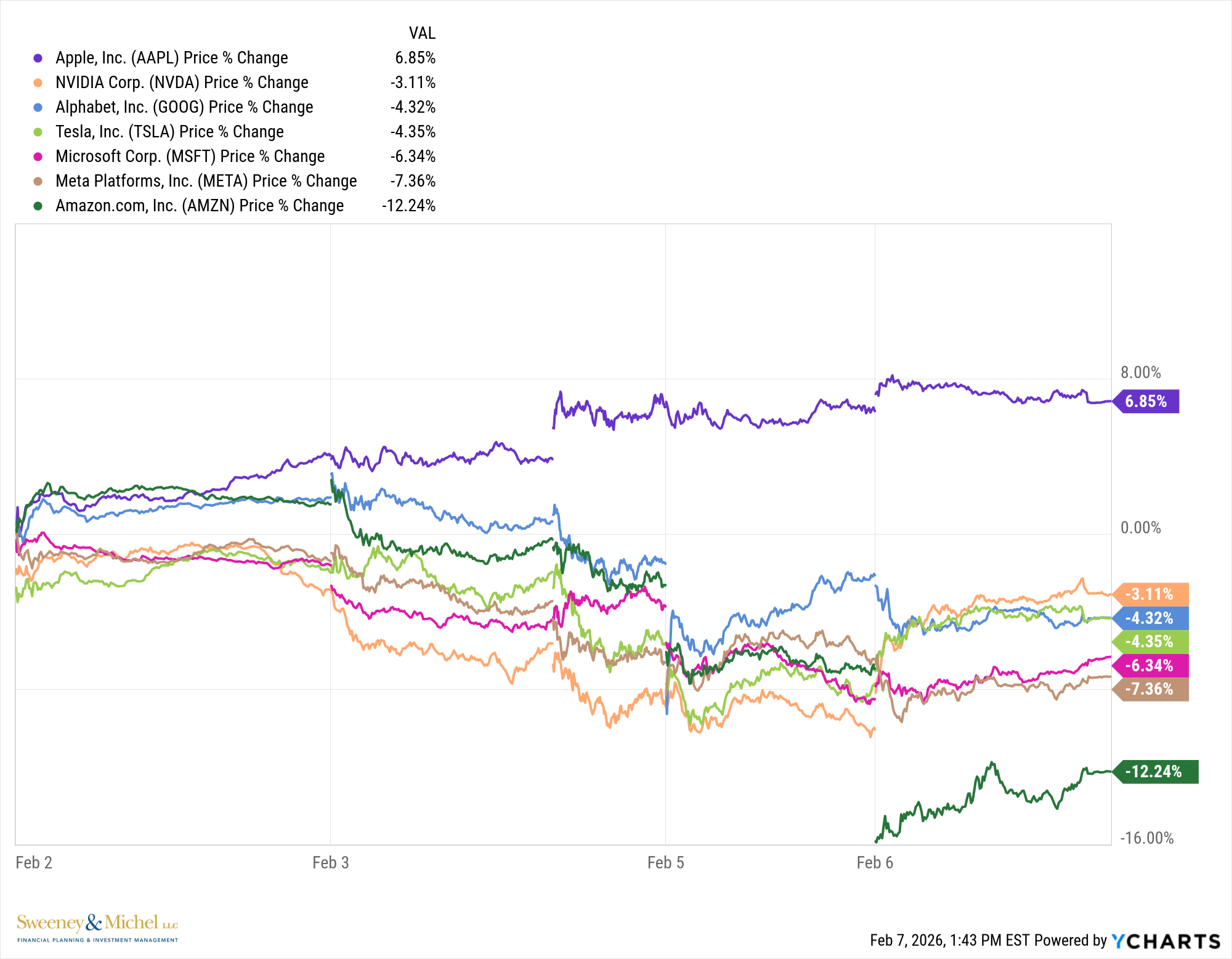

The biggest story in markets last week was the steep drop in software and internet stocks. Recent earnings beats averaged +6.5%, yet the “Magnificent 7” companies like Microsoft, Amazon, and Google got rewarded with a stock beatdown:

The only exception here is Apple, which has chosen to license AI rather than pour hundreds of billions into data centers and develop its own.

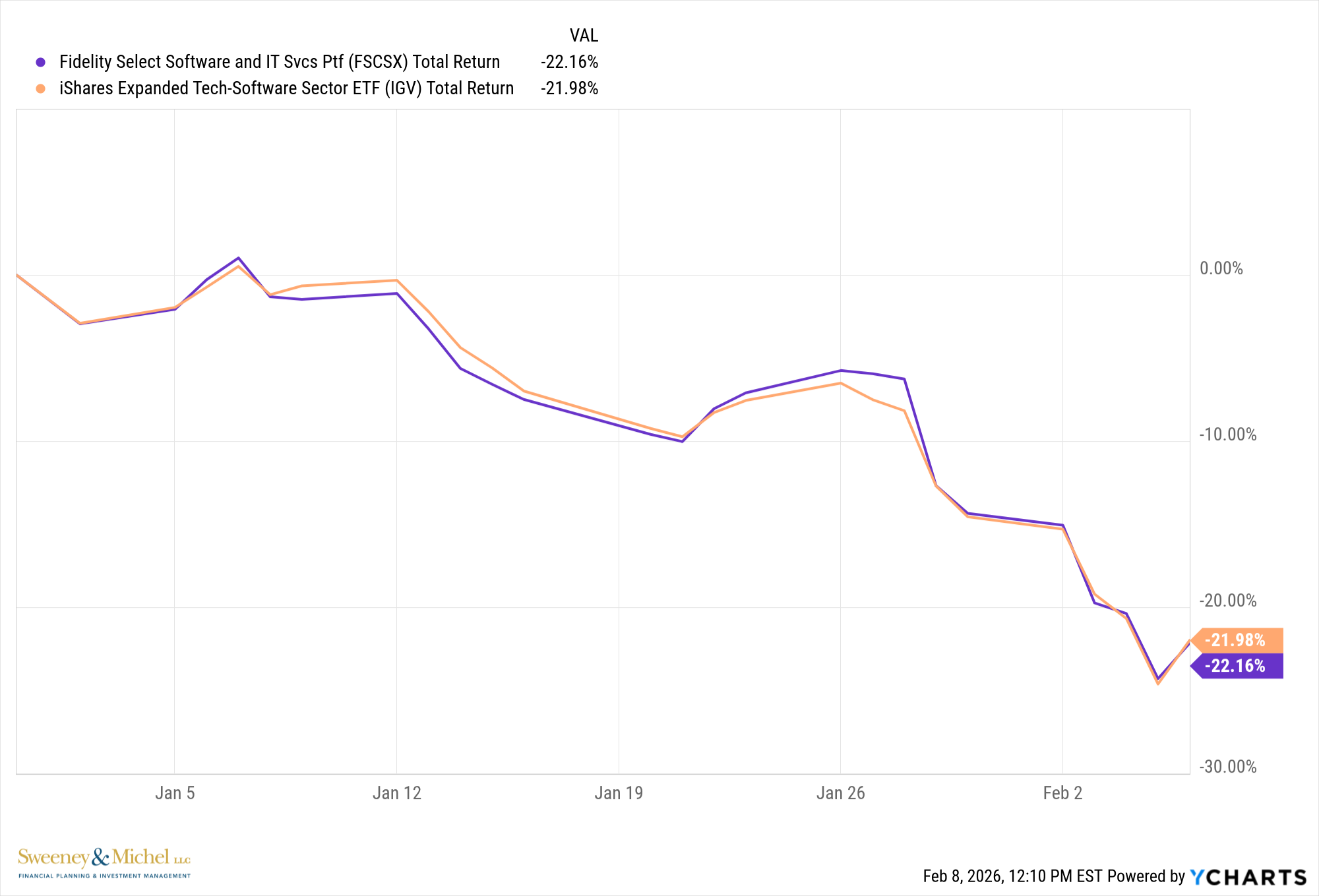

Software stocks have had it even worse this year:

As all parents of siblings know, there comes a time when the firstborn stops seeing the second child as ‘cute’ and instead views them as a threat. Internet 1.0 companies are acting similarly. ChatGPT was fun in its infancy, but this year it turns 4 years old.

You have to wonder whether legacy tech disruptors themselves are going to be victims of AI disruption.

They took our jobs!

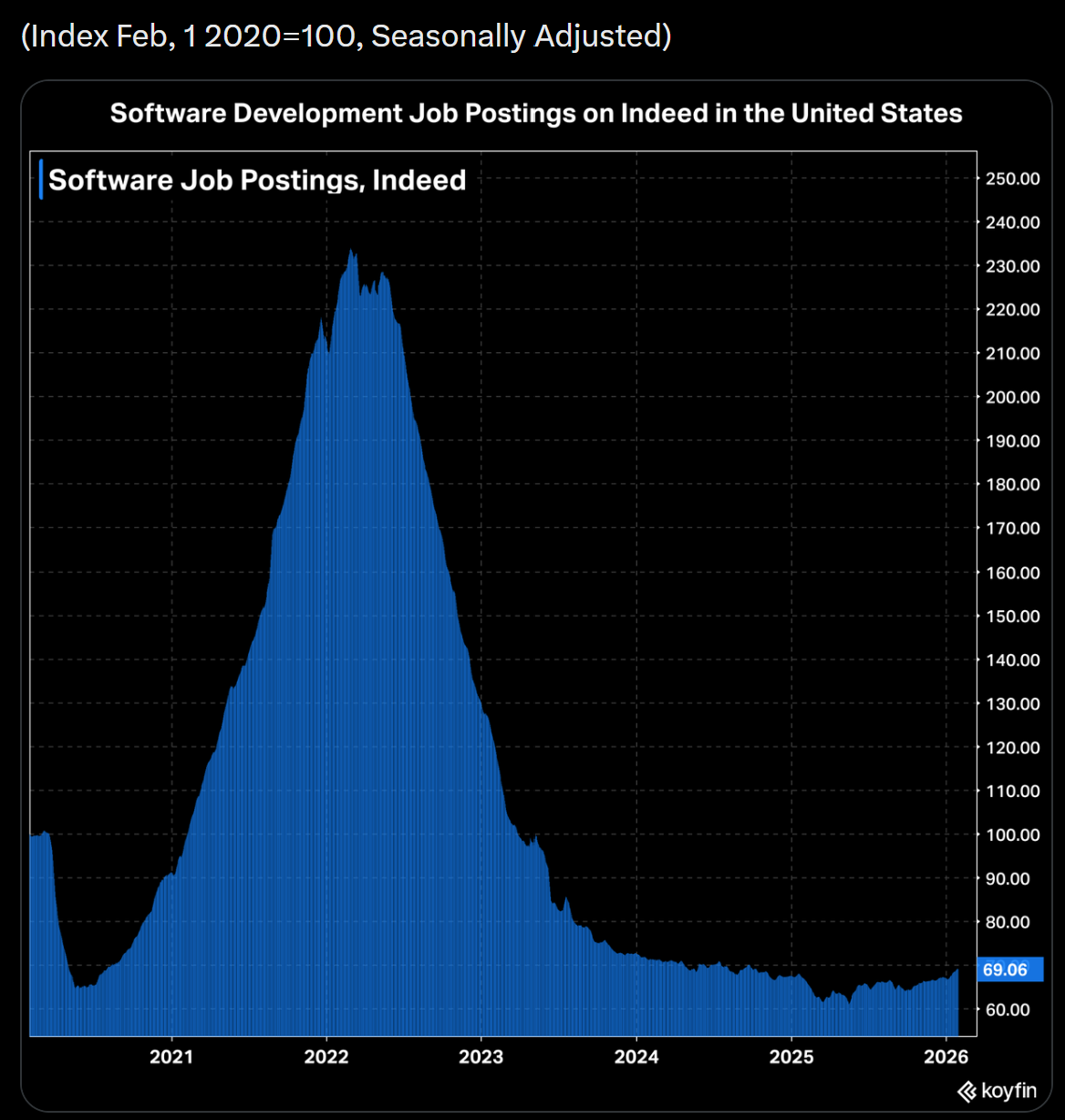

AI coding hasn’t only shaken up the stock market- check out the job openings for software development over the past 6 years:

Not only are companies hiring less developers, but many of the largest tech companies have also been laying off 10-20% of their workforce over the past couple of quarters. Ouch.

Where will we go next?

We’ve written about rich tech P/E valuations multiple times, noting that (in the absence of earnings) any change in the market’s narrative could put pressure on these Nasdaq stocks. That’s true for the first part of 2026.

Our view is that AI isn’t necessarily a full-blown tailwind (like it has been for 3+ years) or a headwind (last 3+ weeks) for companies, but a western wind of change. Wind always blows the hardest against the tallest trees. It makes sense that stocks with high valuations, as the software index in chart 2 (which trades north of 30x earnings) would initially get hit the hardest.

To beat the tree analogy to death, we think companies with the best “root systems” will stand the greatest chance of surviving (and thriving) in a world with AI. Think of companies with a competitive moat, a strong user base, sticky customers, and diverse product offerings. If these companies and products are difficult to recreate, they should withstand threats from AI.

What This Could Mean For Investors

1. If that’s the case, we could see tech stock prices continue to trend down in the short-term but offer some very attractive entry points for long-term investors.

2. Deflation is coming, and lower prices are with it: Increased competition for consumer dollars leads to lower prices. Anyone who can use technology to start a new business that offers products cheaper will always find a market.

3. Interest rate cuts should have a ton of support: The Federal Reserve has a dual mandate when setting the fed funds rate- low unemployment, and consumer price stability. With unemployment ticking up and prices poised to fall, they should have a case (data depending) to cut rates by maybe a full 1% this year