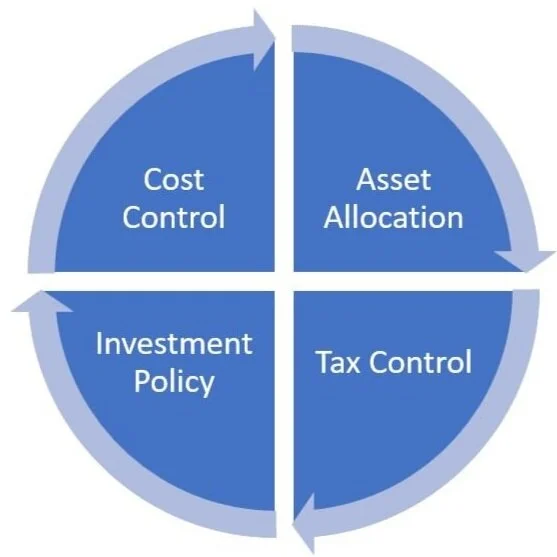

The Four Key Components of Investment Performance

The 4 Key Components of Investment Performance

With so many discussions surrounding the universe of investment options we thought it would be a helpful time to refocus on the four key components of investment performance.

Asset Allocation

This process involves deciding how to divide your money between four main investment categories:

1) Stocks

2) Bonds

3) Cash/Cds/Money Market

4) Alternatives (i.e. real estate, commodities, venture capital, etc)

Academic data going back 100 years clearly shows that asset allocation, not individual security selection, is responsible for 95% of a portfolio’s return. This crucial fact is often overlooked when the media is espousing the hottest new place to invest.

Tax Control

Investment accounts that are funded with after tax money – those owned outside of a retirement plan are subject to capital gain, ordinary income and dividend income tax. Understanding and selecting investments that can minimize taxes is crucially important to improving investment performance.

Stocks held outside of retirement accounts can provide a very significant tax break verses taxable bonds. Stocks can be held individually, within a mutual fund or ETF (exchange traded fund). Taxable bonds pay interest, which is taxed as ordinary income – up to 37% Fed and 13% State. Stocks and stock funds pay dividends and capital gains, which are taxed between 0-20%. ETFs historically have rarely paid out capital gains and can be helpful for high earners to help reduce investment income tax.

Cost Control

Cost is always an important factor when considering any investment or purchase. One of the imporant factors that will affect investment performance is the level of fees and expenses. Mutual funds can have high internal expense ratios (overhead cost to manage the fund), and may be coupled with front end commissions or high advisory fees. Lower investment costs have proven to be strong predictors of performance verses category competitors.

When constructing a portfolio, the total cost must be taken into consideration because every dollar saved will go directly into the pocket (or account value) of the investor.

Investment Policy

An investment policy (IPS) is the written and agreed upon roadmap of your portfolio design and management. It is critical for advisors, as well as clients adhere to the roadmap through challenging and changing market conditions. The IPS can be updated when investor goals, financial situation or risk tolerance changes. An IPS will force responsible investor behavior on the part of the investor and advisor through annual rebalancing when stocks are high and buying when prices are low.

These four components, intelligently managed, provide the foundation for prudent portfolio development.