Avoiding Financial Fraud- What is a Ponzi Scheme?

In early 1919, an Italian-born financier with a background in banking found a loophole in international postal reply coupons. The story goes that there was arbitrage opportunity; free money to be made by buying the coupons in one country and selling them in another. He set up a small office in Boston and began aggressively advertising the size of the opportunity.

With promised profits of 50% in 45 days, it didn’t take long for people to take interest. The first few investors cashed out with real profits, then serious money started pouring in. Some people began mortgaging their homes to make additional investments. There were more new investors every month than the previous one. His bank account swelled to over $3 Million. Within a year, he bought a controlling interest in a bank, a mansion, part of a winery and donated to children’s homes. He once said when he first stepped off the boat from Italy he had only $2.50 in his pocket, but a million-dollar dream.

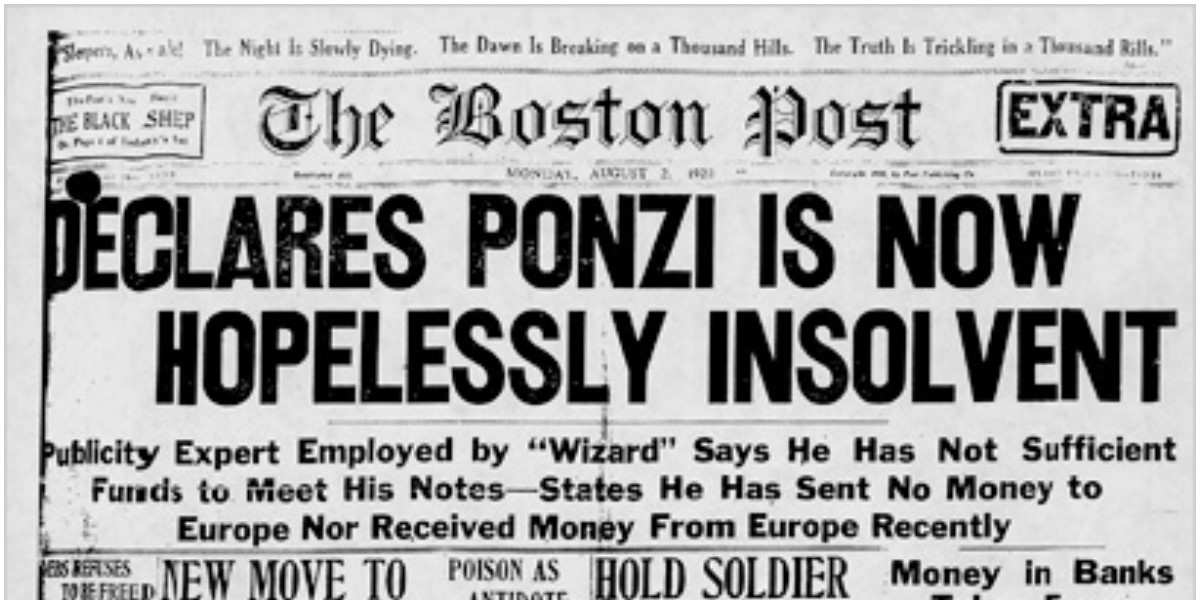

The postal reply coupon opportunity had been greatly embellished. Although there was a small profit to be had, it was nowhere near 50%. The operation was, at large running at a growing loss as it grew. If new investors kept bringing in enough money to pay off old investors, the losses could continue and so could the operation. And it did- until authorities started asking questions and the money carousel stopped. In the end, Charles Ponzi lost his investors $20 Million- the equivalent of $200 Million today.

The expression “robbing Peter to pay Paul” had a new name- the Ponzi Scheme.

The FBI paints a picture of modern Ponzi schemes: “Instead of investing the funds of victims… the con artist pays “dividends” to initial investors using the funds of subsequent investors. The scheme generally falls apart when the operator flees with all the proceeds or when enough new investors cannot be found to allow continued payments.”

Although no Ponzi scheme will ever announce itself as one, most share common traits which can help identify them before you invest:

· Exaggerated earnings claims vs traditional investments

· “Guaranteed” returns with little or no risk

· Overly consistent returns

· Investment deposits are made directly to an individual, rather than a third party custodian

· Unlicensed or unregistered investments and business documents

· Complex or opaque investment strategies

· Unprofessional documentation or inability to substantiate returns

· Delayed or denied payment requests

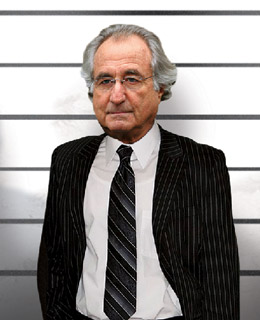

Although many of these seem to be obvious red flags, Ponzi schemes continue to run to this day, and they’re not always small. In fact, Bernard Madoff’s famous scheme lost investors nearly $65 Billion less than a decade ago.

Bernard “Bernie” Madoff

The reason Ponzi schemes continue to attract people is because the low-risk and high return investment opportunities sound too good to be true. In reality, that’s usually the case.