10 Unofficial Rules For Investing (And Making Money) In The Stock Market

1. Time in the Market > Timing

Most Investors’ biggest, multi-bagger gains are long term, and their losses tend to be short term. So, there must be a lesson in here somewhere.

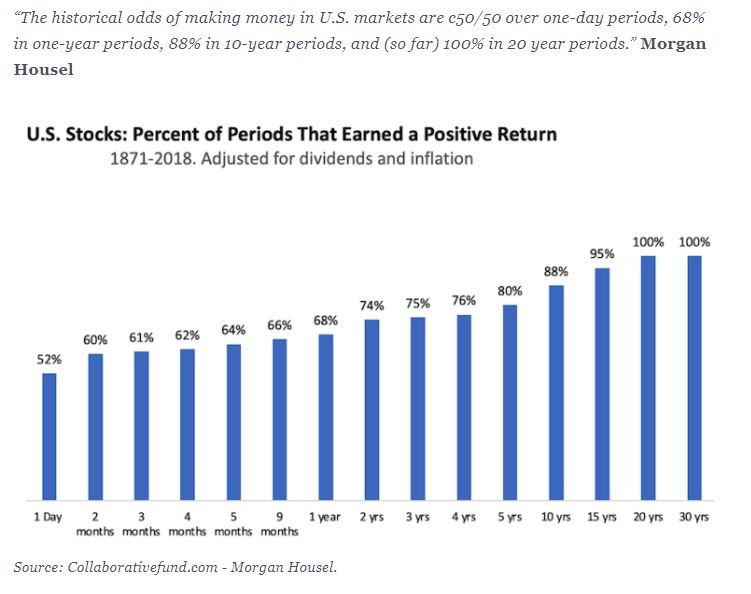

On an average day, you’ve got basically a 50/50 chance of the market being up or down. But if you extend your holding period, the odds of success grow substantially:

2. Compounding Takes Time

Warren Buffet, at 91 years old, has built his net worth and charitable gifts to over $250 Billion through investing. The “Oracle of Omaha” is often regarded as the best to ever do it.

While being an excellent investor, he also had the power of time on his side. In fact, he’s made 90% of his money after turning 65.

The truth is, Warren has been investing since he was 10 years old. He “only” had $1 Million by 30 but didn’t stop there. The investments just kept compounding, uninterrupted, for 60 more years.

Morgan Housel writes:

“There are books on economic cycles, trading strategies, and sector bets. But the most powerful and important book should be called “Shut Up and Wait.” It’s just one page with a long-term chart of economic growth.”

3. Think Like an Owner

It’s tempting to look at stock tickers and try to catch a rising star. However, stock prices move for a variety of reasons in the short term- not all of which make sense (just ask the meme stocks).

Peter Lynch (manager of the Magellan Fund, author of “One Up on Wall Street”) wrote:

The single most important thing to me in the stock market, for anyone, is to know what you own. I am amazed at how many people own stocks, they would not be able to tell you why they own it… If you can’t explain to a 10-year-old in two minutes or less why you own a stock, you shouldn’t own it. And that’s true I think of about 80% of people that own stocks.

If you understand the business behind the ticker, what they’re doing and how they make money, you’ll have an easier time weathering the ups and downs of market cycles.

This is why Warren Buffett always talks about “owning businesses” not “trading stocks”. His approach to investing? “If you don't feel comfortable owning a stock for 10 years, you shouldn't own it for 10 minutes.”

4. Market Caps Matter for Multi-Baggers

What’s an easier proposition: Doubling a Billion-dollar business, or a Trillion-dollar business?

All great companies begin small with an idea and a handful of people, then grow from there.

Apple came public at a 1.8 Billion Valuation. Netflix, Amazon, and Nvidia all IPO’ed at less than $1 Billion Value. They all addressed huge markets and ended up dominating them. Today they’ve all grown 100-fold (or more).

For a chance at above-average long-term returns, size (and luck) matters.

5. Winners Write the History Books

The average return for the stock market from 1926 through today is roughly 10%. However, that doesn’t mean that the average stock grows every year. Far from it: Over the past century, less than 4% of stocks have contributed all of the gains:

Think about it:

The iPhone basically sent the entire Radio Shack enterprise into bankruptcy.

Netflix killed Blockbuster and DVD’s.

Amazon ruined bookstores.

If you can pick just a few winners over decades, your performance will be incredible. If not, owning a diversified index fund or mutual can give you a fraction of the action you need to keep up.

And before you think “gee, that’s boring” keep in mind: The S&P 500 isn’t a stagnant group; It’s an ever-evolving all-star team of 500 great companies. Sam Ro notes that “Since January 1995, 728 tickers have been added to the S&P 500, while 724 have been removed.”

6. Trade Within 10% Of Your Targets

If you must time the market, don’t be greedy. Try to sell shares within 10% of your target high or buy at 10% of your target low.

There’s a lot of money to be made in that 80% middle.

We have clients who never executed buy orders because they wanted to save a couple of dollars per share upon investing, but the price never dropped far enough.

Like they say on Wall Street; Bulls and bears make money, but pigs get slaughtered.

7. Buy Broken Stocks, Not Broken Companies

Every industry, at some point, gets cut in half. The dot com bubble, the real estate crisis, Oil in the 2010s- the list goes on. Markets constantly rotate between what’s hot and what's not.

Companies continue to operate even during bear markets. Starbucks dropped 40% in 2008 but continued selling coffee every day of the year. The stock not only recovered all its losses by 2010; it’s up 700% since then.

For one reason or another, in one season or another, great companies’ stocks will get crushed. If you own one of these stocks, and the business is surviving, try to hang on until the panic is over. If you’re able to buy more, buy more.

As famous investor Shelby Davis wrote: “You make most of your money in a bear market; you just don't realize it at the time.”

8. You Make 80% Of Your Profit In 20% Of The Time

In early the early 2010’s, the sale of laptop computers was dwindling, and the iPad hadn’t quite taken off yet. Cloud computing was slow and clunky. For years, you couldn’t give away semiconductor stocks.

Then 2016 came along; Online gaming grew, AI was being built out, and internet bandwidth increased. All created the need for newer, better chips. Valuations for semiconductors grew alongside profits. From January 2016 to Dec 2017, Nvidia’s stock grew 550%, AMD grew 318%, Micron doubled.

One reason why long-term investing is encouraged is that innovation takes time. Most of the time, profits require patience.

9. Concentrate to Get Rich, Diversify To Stay Rich

Most uber-wealthy people owe their fortunes to one business venture or investment that worked out incredibly well. However, concentration means risk, and risk doesn’t always work out.

Look at Bill Hwang, who made (then lost it all) in a handful of growth stocks over 8 years:

Getting rich and staying rich are completely different skills. Studies show 60% of the Forbes 400 members can’t stay on the list for more than a decade. 51 Moguls fell off the list in 2021 alone.

Diversification allows you to participate in the upside and protect on the downside, without risking everything.

10. Markets Aren’t Predictable- But People’s Behavior Is

We’d like to believe that history repeats itself (or at least rhymes), but the truth is we’ve never lived through our current economic scenario before. Markets remain unpredictable because nobody knows exactly how today’s news will play out.

But we do have an ace in the hole: People’s behavior is fairly predictable.

King Solomon, once the richest and wisest man in the world, wrote “What has been, will be again, what has been done, will be done again; there is nothing new under the sun.”

The pendulum of collective investor emotions consistently swings back and forth between fear and greed.

We don’t know how things will work themselves out, but they usually do. Be brave enough to buy when others are fearful, that’s when asset prices are best.

Keep in mind, all rules above are anecdotal, observed over time with hundreds of investors, but not financial advice or securities recommendations.

For those, you’ll need to schedule an appointment at 530-487-1777

or online BY CLICKING HERE 😊

Or, you can return to the blog: