Investing Outlook: 2025

Annual predictions remind us of a line from Fred Schwed jr:

“Where are the customer’s Yachts?” published 1940

This week we hold our annual in-house meeting on the topic of being humbled. Separate from the quarterly review meetings, it’s a roundtable where we order lunch from La Hacienda, and make in-house 2025 predictions for stocks, interest rates, and surprise events. The humility joins our meeting when we review last year’s predictions.

Betting on what lies ahead for the markets is a fool’s errand. Everybody(?) should know this. In 1992 Warren Buffet wrote: “We've long felt that the only value of stock forecasters is to make fortune tellers look good”

What’s most important about this exercise (aside from internal bragging rights) is to honestly assess where markets are at. Under scrutiny, investment opportunities tend to look more or less attractive, never the same. A true time to divide what’s bullish and what’s bull$h!t.

We’ve read predictions from a dozen firms to see what stands out. Here are some standout bits from their 2025 outlooks, followed by our takeaways.

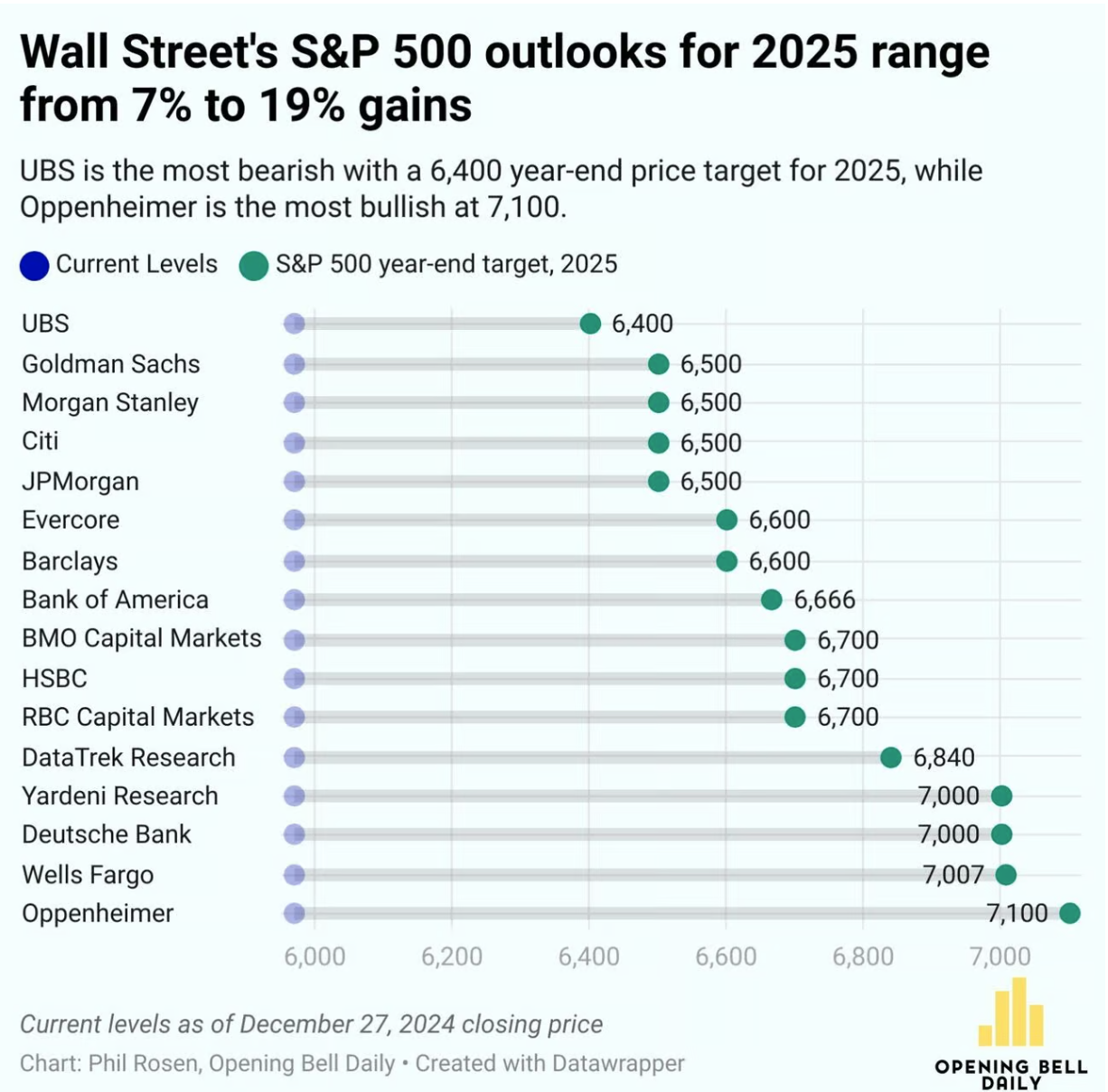

1. Every Big Bank is Bullish

Wall Street’s average market prediction missed by 14.2% in 2024. That didn’t stop them from guessing again in 2025:

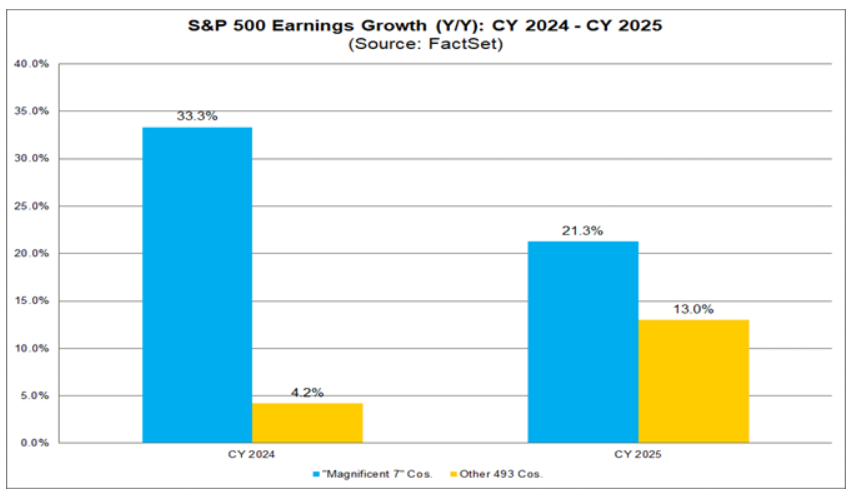

2. Factset: Stock Optimism is Based on High Earnings Expectations

3. However, ‘Stocks for The Long Run’ Author/Wharton Professor Sees a Slower Year (With a Potential Correction) Ahead

“I expect broader market gains in 2025 to be more modest than in 2023 or 2024, with the S&P 500 likely delivering returns in the 0-10% range, and a dip can’t be ruled out. Growth sectors may face headwinds from rising rates, and I can see a case where they are down 10%” -Jeremy Siegel

4. Schwab Notes Price-to-Earnings Valuations Are Higher Than Historically-Average

5. Vanguard: More Guarded Given Starting Valuations

"Here is the catch: Replicating the past decade's stellar returns is not an easy feat — it would require unprecedented earnings growth or historically high valuations"…

“Valuations eventually dominate returns as a ‘fundamental gravity’ -Vanguard outlook ‘25

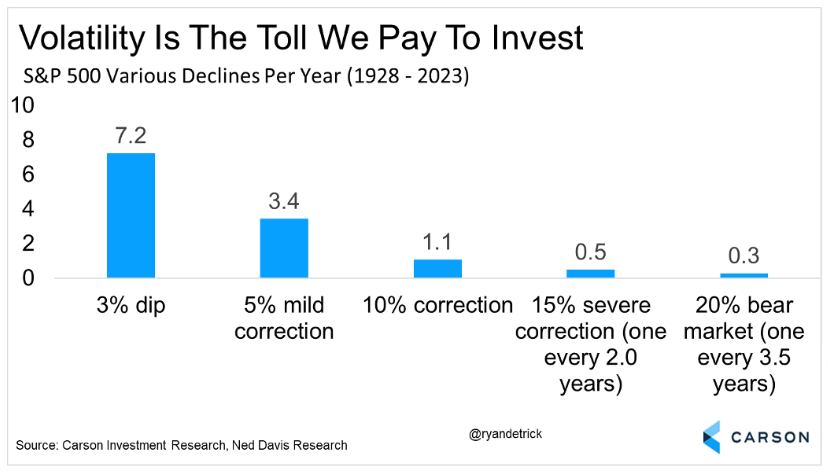

6. Carson Group: Market Pullbacks Are Common

If there’s one chart people should memorize, it’s this one. You normally get:

three 5% drops a year,

a 10% drop (or two) annually,

and a 20% drop every 3-4 years

Pullbacks. Are. Normal.

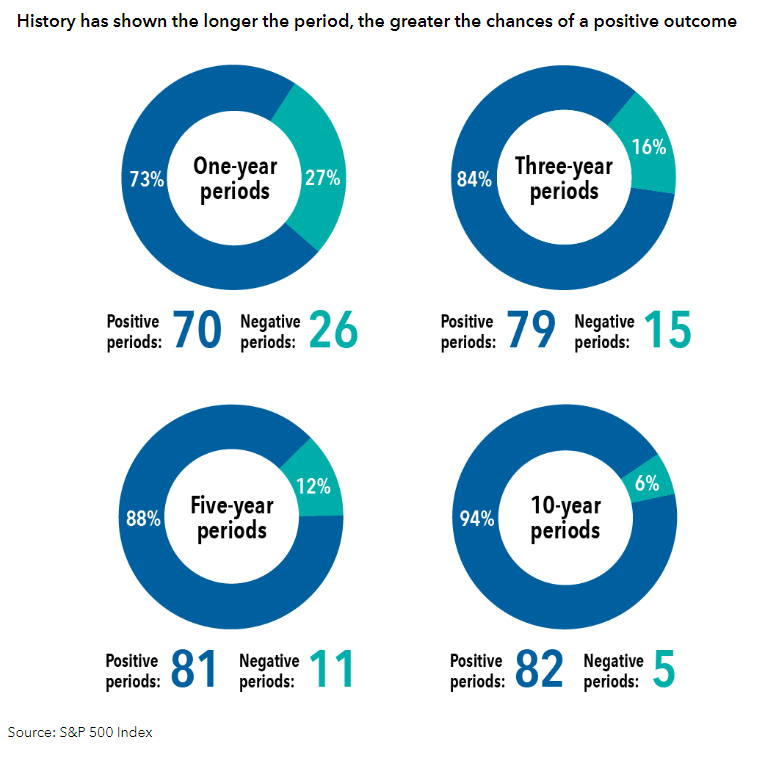

7. “One Way To Reduce Risk is By Staying Invested Longer” -American Funds

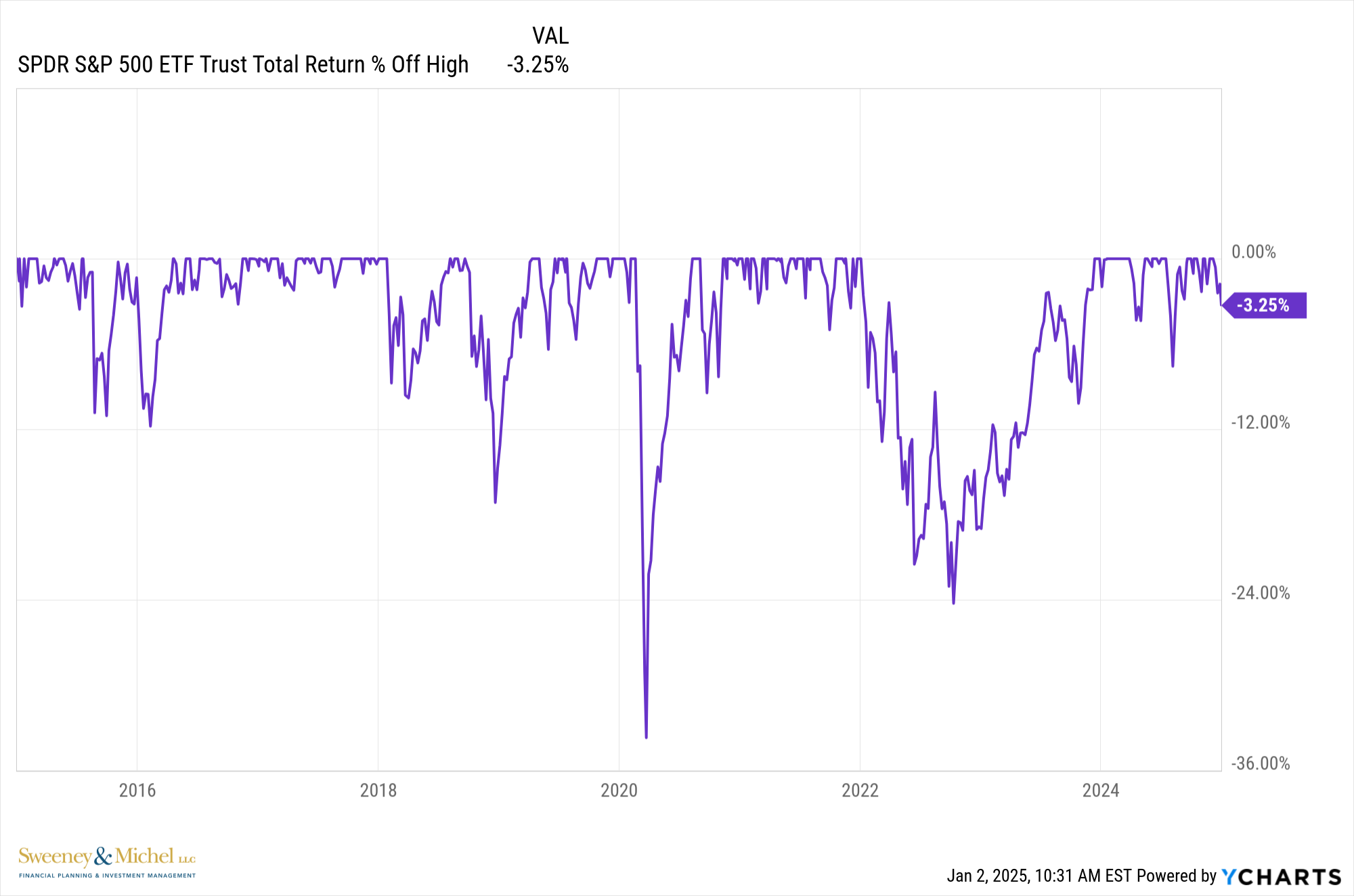

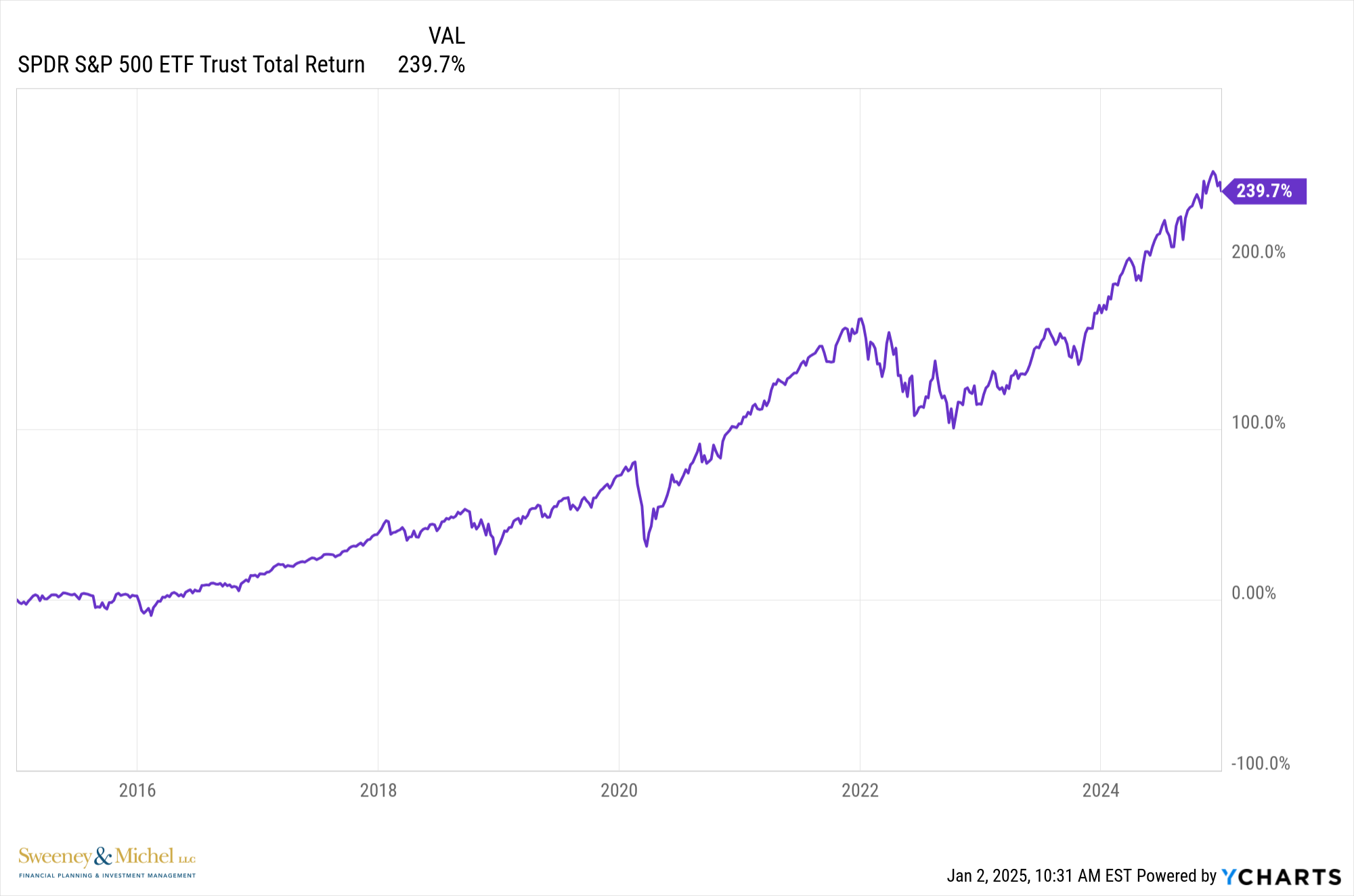

8. Y Charts: If All You Saw Were Pullbacks,

You’d miss the bigger picture:

8. Author Morgan Housel concisely notes:

“Every past decline looks like an opportunity; every future decline looks like a risk.”

Our Best Guess for 2025 is a bend-don’t-break stock market:

When investing, valuations are always a key consideration. Stocks' high valuations today suggest the market expects strong economic growth and earnings.

However, unpredictable global events may cause more stock market volatility in 2025 than we saw (mild in 2023/2024) lately.

As we move into 2025, we expect GDP and earnings to grow. Yet, we should expect a white-knuckle market correction along the way. Unless there's a full-blown recession, this would be unlikely to become a prolonged bear market. It could, in fact, be a great buying opportunity.

Sources:

https://www.wsj.com/finance/stocks/stocks-on-pace-for-best-two-years-in-a-quarter-century

https://www.capitalgroup.com/advisor/insights/articles/2025-macroeconomic-outlook.html

https://www.schwab.com/learn/story/us-stock-market-outlook

Volatility Is The Toll We Pay - Carson Group

2025 PDF Outlooks

Vanguard - Vanguard economic and market outlook for 2025: Beyond the landing Link

J.P. Morgan Asset Management - Link

UBS - Link