Is My Investment Account Safe? We’re Glad You Asked:

I was disappointed (but unsurprised) to get a letter confirming my credit card was compromised after a routine shopping errand at Target. Replacing credit cards is a PITA and with all the recurring subscriptions and bill payments, We’ve got a lot attached to those 16 digits. A year later, I was agitated to update my credit card yet again after Home Depot was compromised.

It’s hard to believe those two massive hacks were over a decade ago. Things certainly haven’t slowed down over time, as just this year the IRS itself got taken in 2024 for 100,000 taxpayer’s info.

Information theft and account hacking are all too commonplace, so one question we commonly get is about account security details. Nobody wants to imagine their life savings at risk.

Most people are usually familiar with deposit insurance through banks provided by FDIC, but not investment accounts. Our primary custodian is Fidelity (for various reasons), but account security is at the top of that list. Here are 4 ways they bolster your account security and mitigate fraudulent requests:

1. Securities Investor Protection Corporation (SIPC)+

Fidelity Investments is a participant in SIPC, a nonprofit organization that protects stocks, bonds, and other securities in case a brokerage firm goes bankrupt and assets are missing. The SIPC will cover up to $500,000 in securities, including a $250,000 limit for cash held in a brokerage account.

Fidelity has an aggregate excess of SIPC policy of $1 billion. Within Fidelity's excess of SIPC coverage, there is no per-customer dollar limit on coverage of securities, but there is a per-customer limit of $1.9 million on coverage of cash awaiting investment. This is the maximum excess of SIPC protection currently available in the brokerage industry.

2. Client Account Security Standards

Current defense includes strong encryption, firewalls, secure email, and proactive 24/7 system surveillance. Fidelity reports they have over 1,000 employees dedicated to cybersecurity. Additionally, you can (and should!) request the following on your account:

3. protection Against Losses From Unauthorized activity

Your Fidelity brokerage accounts, and Fidelity retirement plan accounts (e.g., 401(k), 403(b), 457, or profit sharing plans) are covered. If it wasn’t you, Fidelity will reimburse your accounts.

You can read more about it HERE: Fidelity Customer Protection Guarantee

4. Defense is in the Details

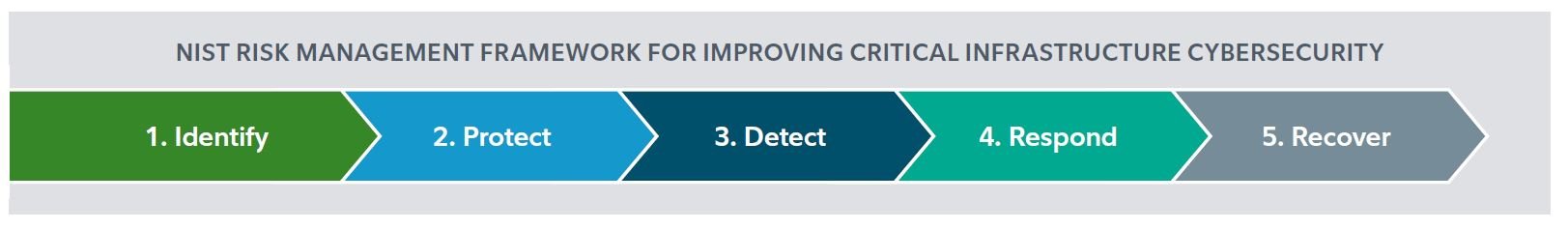

Protecting client data comes down to several processes, from identifying threats to recovering data. Occasionally our clients will notice there’s a restriction added to their account. This is usually due to an identification of some type of threat, and the account was preemptively restricted from trades or withdrawals. While it takes a quick phone call to verify and fix, ew’re thankful for the proactive defense.

To read more about the specifics of the cybersecurity program, you can download their PDF Here:

If you have further questions about account security, give us a call at 530-487-1777