Weathering the Storm: What’s Worked in Investing (and What Hasn’t) During a Recession

Thunderstorms are appearing on the horizon.

Unemployment is ticking up, consumer spending is trending down, and several economists are beginning to wonder whether we’re headed into another recession. This isn’t great news for investors, as the stock market is usually along for the ride when the economy drops.

Slowdowns are, of course, an inevitable part of every economic cycle. The economy changes like the seasons, albeit with less predictability. Recessions all share similarities but are never exactly the same.

Here’s what we know about the timing and length of past recessions:

They happen once or twice a decade: Recessions have occurred in the United States approximately every 6 years since World War II.

They’re usually 6-18 months long: the average length of a recession is 11 months according to the National Bureau of Economic Research

It’s been 4 years since the last one: 2020 saw an extreme (but brief) 2-month recession during the Covid outbreak and lockdowns

Chances are you’ll live through several recessions (and subsequent rebounds) during your investing lifetime. Pullbacks in the economy and stock market can shake your investing confidence, but they don’t have to if you have the right expectations.

While uncomfortable, here are 3 ways investors have benefited through past recessions:

1. Embrace Defensive Stocks

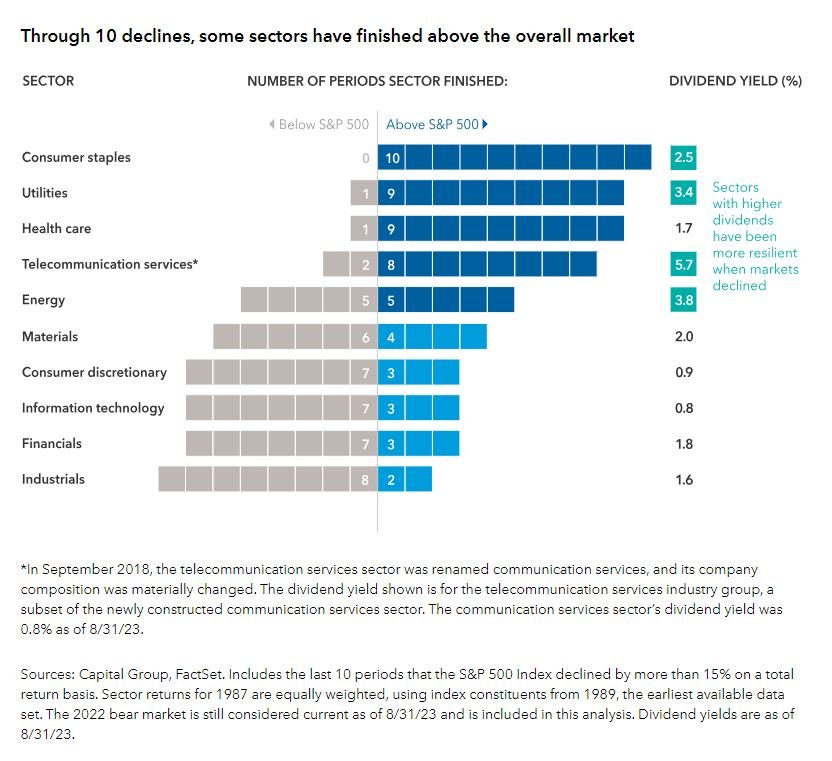

This one is intuitive, don’t overthink it. As consumers tighten their spending, look for companies that will continue to get wallet share. Goods & services from Utilities, Consumer Staples, and Healthcare providers are things people are reluctant to cut spending on; Regardless of the market cycle.

They may not be sexy, but these industries usually have predictable earnings, strong balance sheets, and pay dividends to patient shareholders. The dividend payments can help growth investors offset portfolio losses and provide retirees with a consistent stream of income.

https://www.capitalgroup.com/individual/insights/articles/guide-to-recessions.html

2. Consider Bonds for income, diversification and principal stability.

Stocks may help you eat well (over the long run), but bonds help you sleep well in the short term. Their principal guarantees and regular income payments can stabilize a portfolio’s value. Bonds are usually very resilient when recessions hit:

https://www.mfs.com/en-global/institutions-and-consultants/insights/fixed-income/fixed-income-investing-in-us-recessions.html

3. One Man’s Loss Could Be Another’s Gain

Recessions and bear markets can be excellent entry points for new money.

There’s a reason Warren Buffet goes on the offensive, buying companies left and right during times of crisis: That’s when the prices are best.

https://www.nytimes.com/2008/10/17/opinion/17buffett.html

If you have money to invest, consider dollar-cost averaging money into your portfolio: This is where you invest a fixed amount of money at regular intervals. This strategy helps you buy more shares when prices are low and fewer shares when they're high, smoothing out the impact of market volatility over time.

Indeed, some of our clients’ best investments were purchases made during bear markets and times of distress.

Remember…

“When it comes to so-called market timing there are only two sorts of people: those who can't do it, and those who don’t know they can't do it.”

-Terry Smith

Timing the economy is hard, and timing the market based on the economy has been proven nearly impossible. Even if a recession starts tomorrow, most investors will fail to get out at the top, and then get back in at the bottom. Trying to time when to buy and sell stocks often results in terrible performance. A buy-and-hold approach usually wins over market timing.

Focus on what you can control: staying informed, staying invested, and saving what you can through the pullbacks.

And remember, everything is temporary.

If you have questions about your portfolio or investment approach, we’re happy to help. You can schedule an appointment online or by calling at (530) 487-1777