Retirees’ Ace In The Hole

We haven’t seen retirees this nervous in a decade- they’ve had a tough year with asset prices falling. Everyone knows that bear markets can be advantageous to folks who are employed and saving (they can buy throughout market dips). Once you’re retired, though, you’re somewhat at the whims of the market.

While looking at a chart of stocks and bonds, most would happily time-travel back to the fall of ‘21 and move it all to cash if they could. Unfortunately, savings accounts and bonds were paying next to nothing at the time and weren’t viable investments for people needing lifetime income.

Conservative investing is difficult when interest rates are 0%; It’s a bit like being a vegan in a steakhouse. You might not agree with most of the menu, but if everyone around you is eating well and you’ve been starving, it’s easy to throw caution to the wind and dive in. Stock and bond prices got bid up until there was a viable alternative. The market’s appetite was only curbed when risk-free rates rose a few percent.

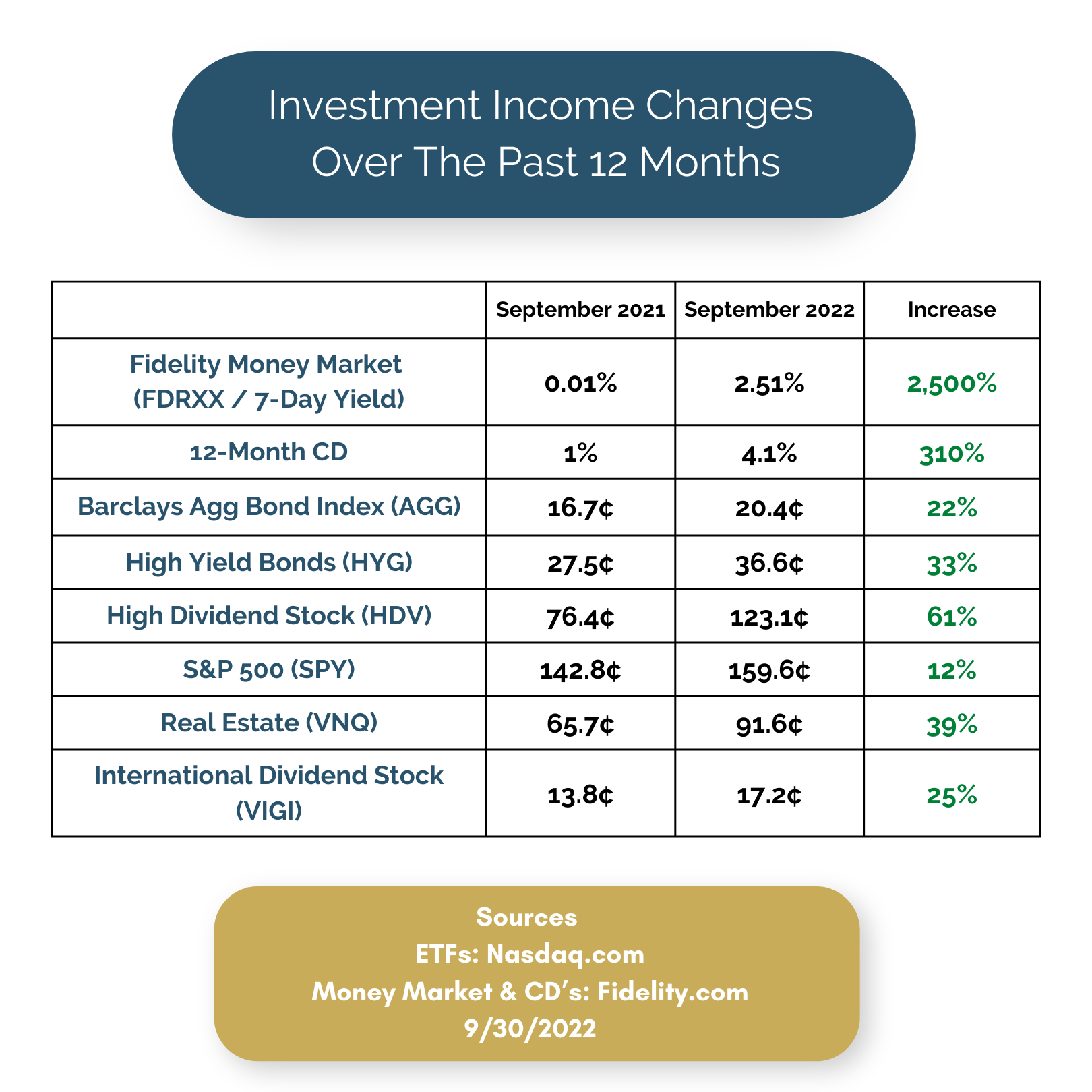

Still, the rising rates that punished the markets have quietly helped retired investors. Rising inflation and interest rates haven’t just helped savings accounts, they’ve had a dramatic effect across the investment universe:

Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Investments in securities involve the risk of loss. Past performance is no guarantee of future results. Sweeney & Michel LLC manages its clients’ accounts using a variety of investment strategies, which are not discussed in the commentary.

Imagine you bought an investment property for the purpose of generating rental income over the next 30 years. A year later, a realtor tells you it will appraise for 20% less than you bought it for.

However, you’ve been able to raise the rent by 12% since purchasing-and these renters have a fantastic history of paying on time. Would the appraisal comment really bother you?

Now- apply that thought process to your stocks and bonds.

The primary financial concern of every retiree is outliving their money. The current markets haven’t been pretty, but the takeaway from this year has been a double-digit increase in income. That alone should help them stomach the price volatility.