Who Turns The Pages When The Storyteller is Gone?

One of the world’s most visionary and creative storytellers, Walt Disney, died 56 years ago this week.

His company was in curious shape at the time of his passing; Disney World was still 2 years from being opened in Florida, the film division hadn’t had recent hits outside Mary Poppins, and the new CEO Roy Disney (73) was always the financial muscle, not creative like his brother.

Critics argued about the future of Disney without its visionary founder.

Indeed, the company struggled without direction through the late 60’s and 70’s. What role could Mickey Mouse play in a world dominated by the Vietnam war, Watergate, high unemployment, and raging inflation? Predictably, the stock price floundered.

Things got worse without clear direction and experience at the helm,

Corporate raiders began circling the waters, intending to split up the company and sell it for parts. However, in 1984, an unexpected return to the boardroom (seemingly straight from a Disney script) changed everything. Roy Disney’s son (Roy E. Disney) brought in a couple of Texas-based billionaire brothers, who bought up enough shares to keep the company together. They had a vision.

Newly appointed CEO Michael Eisner hit the ground running

Disney Animation scored a string of film successes in the 80s and 90s. The actual home run during his tenure though was the mega-merger with ABC/Capital Cities broadcasting in 1995. Disney/ABC/ESPN became the world's largest content/distribution company overnight. It was a two-decade turnaround worthy of a star on Hollywood’s Walk of Fame- Which Eisner got.

But, where would they go from there?

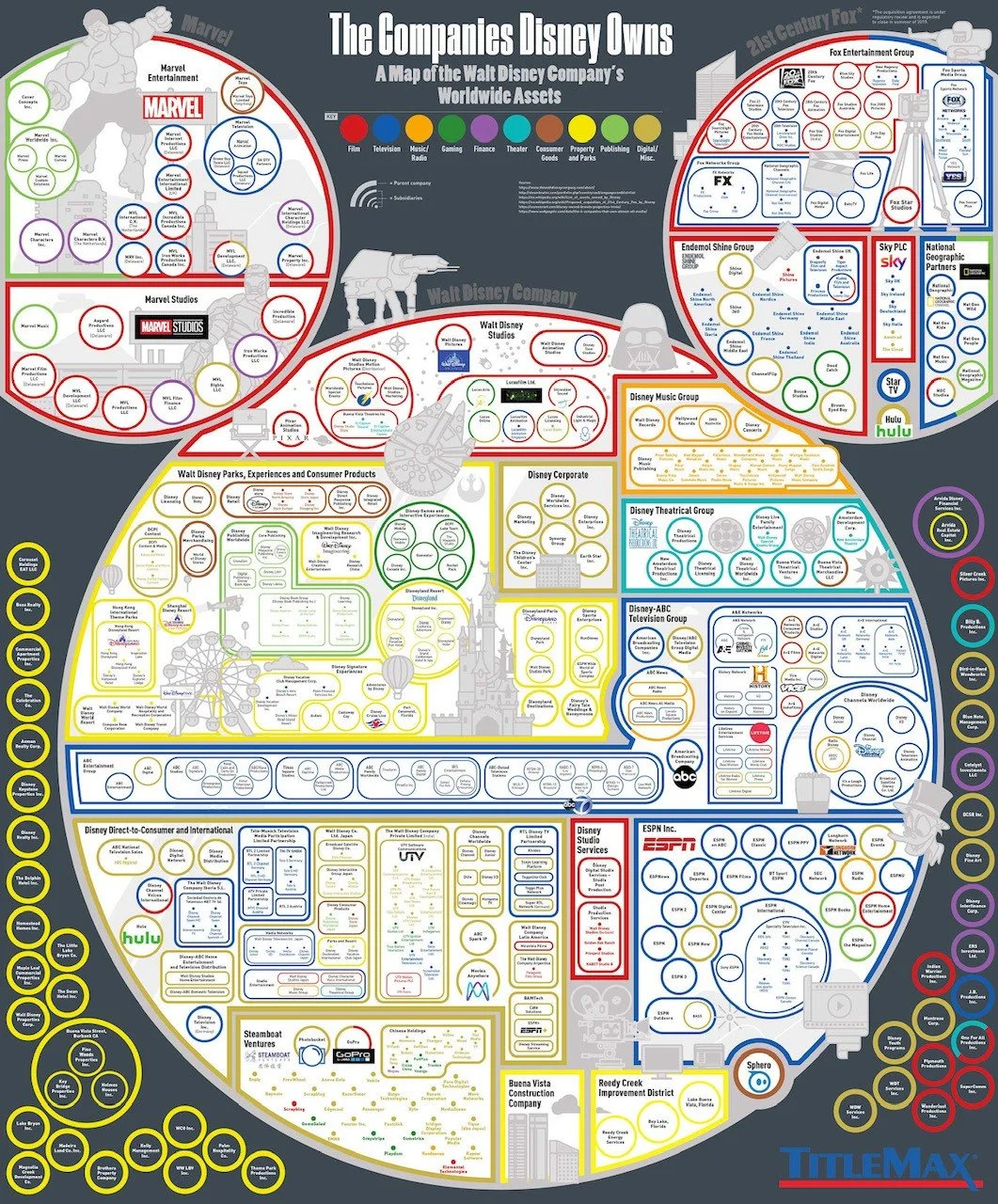

Bob Iger took the CEO chair in 2005 just prior to the Great Financial Crisis: through those years he went on the offensive and brought in three of the greatest franchises of all time: Pixar, Marvel, and Lucasfilm.

Their impact was immediate; Annual revenue grew by over $31 Billion from 2010-2019. Today, Disney is a Galactic Empire in it’s own right:

After just 2 years of retirement, Bob Iger returned to his CEO post this month. The board felt that “happily ever” needed a different direction than Bob Chapek was taking them in.

We’ll see what the next chapter holds.

The point is this: A lot has changed in the world since Walt died.

There’s been 7 recessions, 14 major US military operations, and 12 changes to corporate federal tax rates between 1966 and 2022. Countless political and social movements have come and gone. Home video formats have migrated from VHS to Laserdisc to DVD to Blu-ray to now, streaming.

Today, Mickey Mouse & Co

enter 164 million homes every month on Disney+. That would have been unimaginable, even for the Imagineers who worked in a time before the internet was invented.

Although volatile, Disney’s stock price followed company growth over the past 60 years:

The story of Disney is the same as the many great American businesses.

Apple thrived after Steve Jobs died. Microsoft hit a new stride after Bill Gates and Steve Ballmer left. Coke, JP Morgan, and Johnson & Johnson have all been adapting to new environments for longer than most of us have been alive. I take comfort in investing in companies like these.

Great American businesses face adversity and grow over time. They have boards of living, breathing people who all get in their cars and drive to work listening to the same things we do. They know when interest rates are going up and when the economy looks like it’s slowing down. They tighten their financial belts, replace bad leaders, and embrace new technology as it arrives.

There’s so much more to a company than its’ ticker symbol.

Year-ahead forecasts are beginning to arrive

Popular economists are guessing whether stocks will be up, down, or sideways over the next 12 months. As we know, stock prices can be volatile. However, I’d encourage you to remember that companies are usually much less volatile than their stock price is. They adapt as we all do.

And the great ones are worth holding onto through every cycle.

PS. None of the above mentions of stocks are personal financial recommendations. I own quite a few of them, but everyone’s risk tolerance and time horizon vary. Give us a call if you’d like to discuss yours.

PPS. If you’d like to hear from the companies/stocks themselves, check out the Quartr app (https://quartr.com/). They have on-demand earnings call replays for virtually every publicly listed company, complete with the Q&A session which addresses year-round risks, opportunities, revenue, and expenses. When the economy and markets are choppy, I find it very helpful to hear from the management team on how they are addressing challenges.