Everyone Is Expecting a Recession in 2023

The economic alarm bells are ringing

You can hardly turn on the TV or open a newspaper without seeing someone predicting a recession this year; one poll shows 80% of Americans expect the economy to start its backslide soon.

Popular CEOs, news outlets, and market pundits have been sharing this dire prediction since early 2022. The S&P 500 dropped 27% at one point last year on the forecast.

Thus far, the predictions have been very wrong (or very early?): Q4 GDP grew 4.1%.

Still, forewarnings abound.

recessions naturally panic investors

The common thought process goes: “If a recession is coming, my investments will go down. Therefore, if I can sell before the recession, I’ll save a ton of money (and a headache)”

On the surface, that seems fair. But life and markets are rarely that simple.

Let’s assume, for a moment, that the most well-advertised recession in history finally arrives: Will stocks drop? Maybe, but maybe not, because:

Stock prices reflect future expectations, not the current reality

Stock prices are forward-looking, meaning the recession forecast is likely already priced in.

That would help explain the bear market in 2022. One possibility is that last year’s market drop was fueled by recession fears. However, If data continues to show a healthy economy, we think prices could rebound as economic fears abate.

After all; mass pessimism today means there are plenty of future buyers tomorrow if/when their mood rings change.

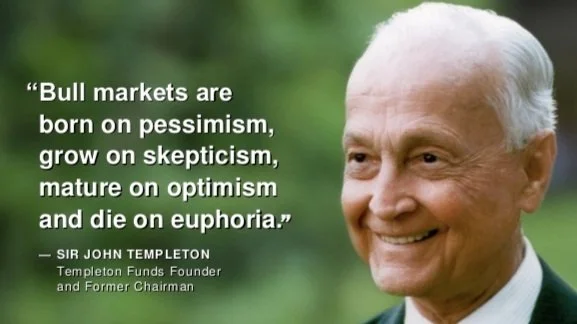

In fact- Investing in times of mass pessimism was a business model for one of the greatest investors of all time:

Investing amid scary forecasts isn’t just anecdotal advice: Historical data from JP Morgan supports the strategy of investing through recessions:

If you remember one thing about investing, make it this:

markets typically rebound long before the economy and public perception does

By the time you feel good about investing, it will be too late. That’s why staying the course is (usually) our best bet.