Earnings Put Stocks to the Gunpowder Test

Early in 17th Century England, hard alcohol was becoming a big deal. Distilled spirits (or Eau De Vies- “Water of Life”) such as rum or gin were catching on as an alternative to cider and beer. It was being used as currency, taxed by volume, and given to sailors in the British Royal Navy at the rate of a 1/2 pint daily.

Despite explosive category growth, there was an issue: The alcohol’s strength was a guessing game. The scientific proof system we know and use today wouldn’t come along for another 100 years.

The “Gunpowder Test” was developed. As the story goes, soldiers in the British Royal Navy would apply rum to their gunpowder to test its strength. If the powder lit and the weapon fired, they had “proof” that the rum was strong enough (more alcohol than water).

The stock market is a forward-looking, cash-flow discounting animal. Stock prices tend to follow earnings over long periods of time. Predicting the downfall and rise of the economy over the last 2 years would have been tough, to say the least.

The pandemic was a blur for all of us, and we all held onto stories and beliefs to get us to the other side. The market is no different, as it looked past stormy seas to a day when the economy and earnings reports were operating under blue skies. It appears we’re finally getting there.

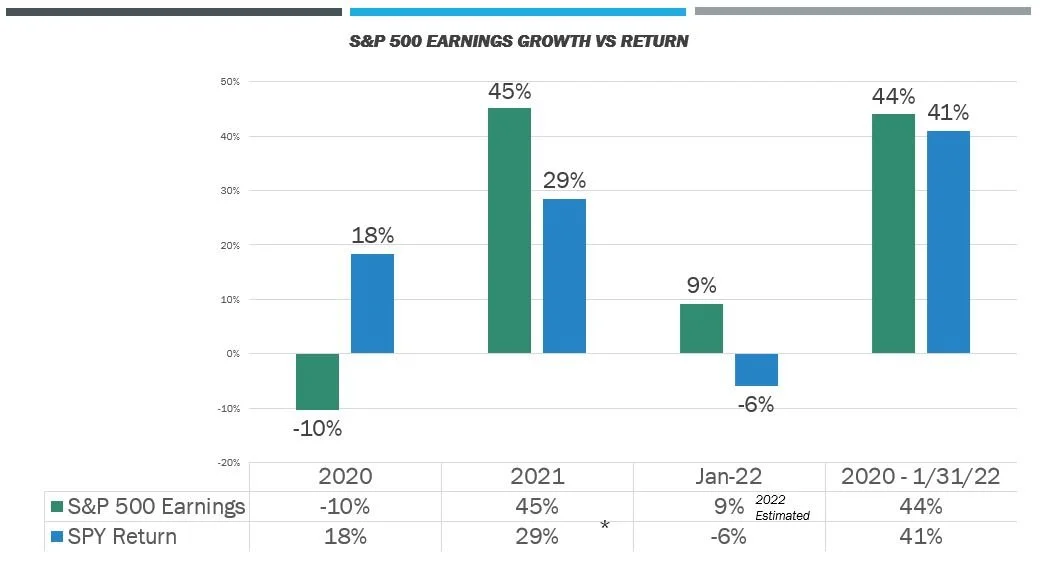

To its credit, the market has mostly gotten the pandemic earnings right so far, with earnings and stock prices within 5% of each other:

2020 was expected to be bad, 2021 saw earnings rebound, and 2022’s market action put it damn close to breakeven for the past 2 years.

As the world and economy are beginning to re-normalize, I would argue this earnings season is possibly the most important we’ve had since early 2020.

These earnings reports will be the Gunpowder Test for several of the biggest stocks in the market. They’ve been distilling fact from fiction, earnings from the narrative. Nobody’s predicting 200% user growth on their tech platform as we all head back to school or the office.

Rightfully, earnings beats have buoyed stock prices to nearly breakeven for 2022, while misses have gotten them completely dismantled. Take a look:

|

Company |

EPS Surprise vs Consensus |

2022 YTD Return |

|

Meta (Facebook) |

-7.3% |

-30% |

|

Apple |

7.7% |

-0.97% |

|

Amazon |

530% |

-6% |

|

Microsoft |

3.8% |

-6.8% |

|

Netflix |

52.9% |

-32% |

|

Alphabet (Google) |

5.1% |

2.3% |

|

Paypal |

-4.3% |

-30% |

|

Tesla |

-3% |

-14% |

*Earningswhispers.com, csimarket.com data as of 2/3/22

The rapid repricing of stocks coming off sugar highs is probably more surprising than it should be. The days of Sailor Stories are behind us.