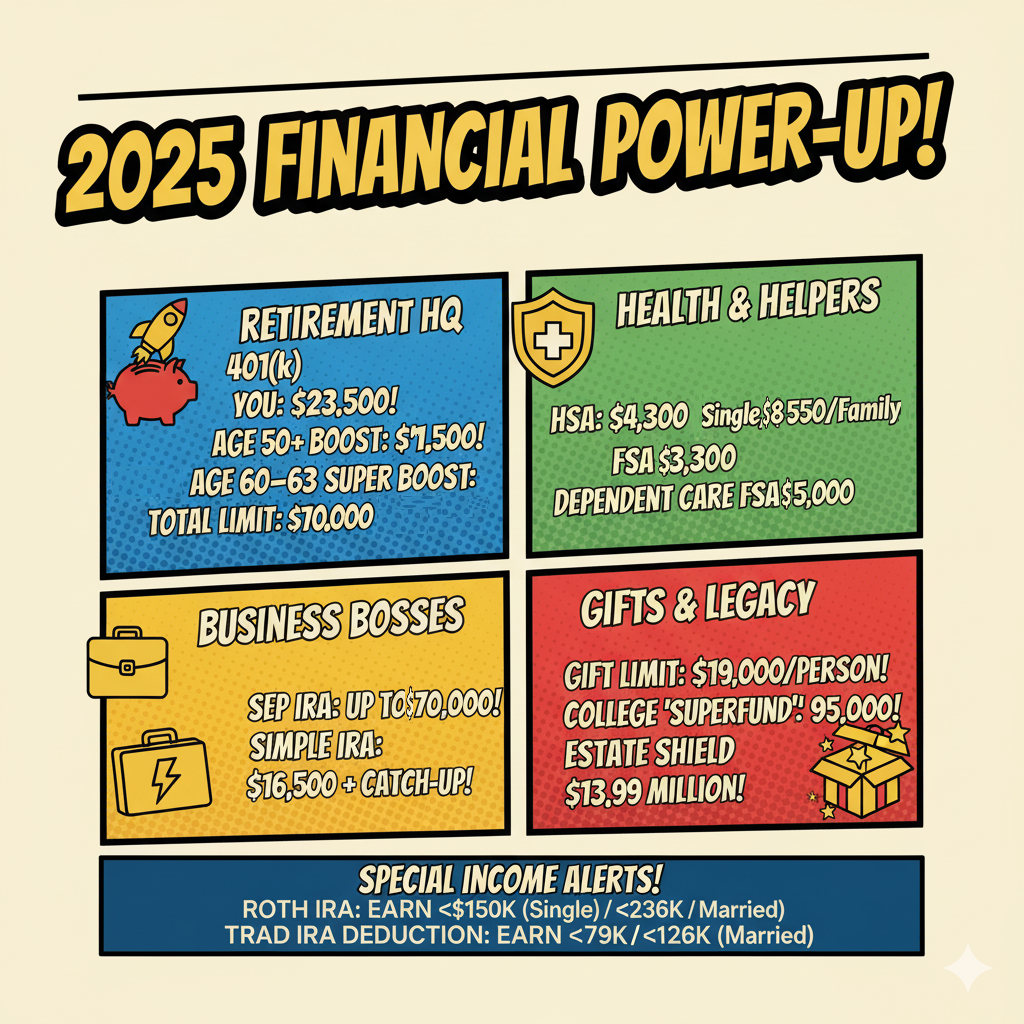

Money, 2025: Your Guide to Retirement, IRA, HSA, & Gifting Limits

Every year, the government sets new rules for how much money you can save or gift in special accounts. Here are the most important numbers for 2025:

Saving at Work In a 401(k) Plan or similar

Your Part: You can put in up to $23,500 from your pay.

Catch Up for Age 50-59: If you are 50 to 59 years old, you can add an extra $7,500.

Super Catch Up for Age 60-63: If you are 60, 61, 62, or 63, you can add a new, bigger extra of $11,250.

The "Grand Total": The limit for all money (your part, your boss's part, and any other money) is $70,000.

The "Catch Up Contributions" for being over age 50 can be added on top of this.

Saving on Your Own (IRAs)

Your Part: You can put up to $7,000 between your own Pretax or Roth IRAs.

Extra for Age 50+: If you are 50 or older, you can add an extra $1,000 (for a total of $8,000).

o Roth IRA (Income limits): To put money in a Roth IRA, you must make less than $150,000 (if single) or $236,000 (if married).

o Traditional IRA (Tax Break Rules): If you have a 401(k) at work, you only get the full tax break if you make less than $79,000 (if single) or $126,000 (if married).

o "Backdoor" Roth: This is a trick for people who make too much money for a Roth. There are no income limits but be careful! It can get tricky if you have other, older IRAs.

Saving for Health and Family

Health Savings Account (HSA):

$4,300 (for one person)

$8,550 (for a family)

Health Flexible Spending Account (FSA): $3,300

Dependent Care FSA (for kids/family): $5,000

For People Who Own a Business

SEP IRA: You can put in up to $70,000 (it's based on your profit).

SIMPLE IRA: You can put in $16,500 (plus the extra money for being over 50).

Standard Catch Up of $3,500 (Ages 50-59 and 64+)

Super Catch Up of $5,250 (Ages 60-63)

Giving Money to Others

Annual Gift: You can give $19,000 to any person you want, and you don't have to report it.

529 College Plan Gift: You can put $95,000 (which is 5 years of gifts) into a college plan all at once.

Estate Exemption: This is the amount you can leave behind when you pass away without paying a special federal tax.

$13.99 million (for one person)

$27.98 million (for a married couple)

Source: irs.gov