An ESG Investing Guide: Finding the Good, Avoiding the Bad, and Identifying What is Greenwashed

You’ve probably seen the letters ESG; It stands for Environmental, Social, and Governance, and it has become one of the most talked-about trends/factors in investing over the past decade. Whether you call it “Socially Responsible” “Sustainable” or “Environmentally Conscious”, there have been hundreds of investment funds and firms popping up to target the issue.

My first gig out of college in LA was with an ESG consultant in 2009. He had a 3-person business and consulted with S&P 500 companies. He showed me the difference between which companies were making a positive impact and those that just wanted to change their marketing (but not their practices). It helped to inform us about what we look for when building these portfolios for clients:

The ‘Socially Responsible’ Proposition

The concept is simple: Invest your money to not only grow your wealth but also to support companies that are making a positive impact on the world. Can your portfolio really align with your values?

That’s the promise of ESG. But with any investment strategy, the reality is far more complex. As a financial planner, here’s how we look past the hype and understand what’s really under the hood.

The Case FOR ESG: Why It Can Work

The main arguments for ESG investing are that it’s not just about "feeling good", but also "investing smart."

It's a Risk-Management Tool:

Company scandals are expensive for investors. If you could sidestep BP’s oil spills, Facebook’s data scandals, or Wells Fargo’s account fraud, you would have sidestepped gigantic market losses while the companies paid Billions in settlements. ESG analysis aims to identify these risks before they affect a company's stock price.

It Focuses on the Long Term:

An ESG-focused company is often, by definition, forward-thinking. It anticipates future trends such as the shift to clean energy, the demand for more inclusive workplaces, and consumer preference for ethical brands. On paper, these companies may be better positioned for sustainable growth over the next few decades.

It Aligns Capital with Values:

For many investors, this is the main draw. They want to know their money isn't actively funding poor practices. ESG provides a framework for improving that alignment.

The Case AGAINST ESG: When It Might Disappoint

Skeptics argue that ESG screening and investing is a costly marketing gimmick, here’s why:

The Performance Debate:

This is the big one. If you intentionally exclude entire sectors from your portfolio (like traditional energy, tobacco, or defense), you’re going to look great when those sectors lag the broader market. While some studies show ESG funds historically outperformed, that performance could simply be attributed to concentration in sectors (like technology) that happened to have high market returns.

Subjectivity:

What, exactly, makes a company "good"? Phillip Morris famously has a high ESG score because they have a diverse board and great employee benefits. Yet Tobacco use continues to kill eight million people a year. Is this really the Socially Responsible company that analysts want you to believe it is?

Data Method Chaos:

Among analysts, there is no single standard. The rating agencies that score companies all use different methodologies, leading to wildly different "ESG scores" for the same company.

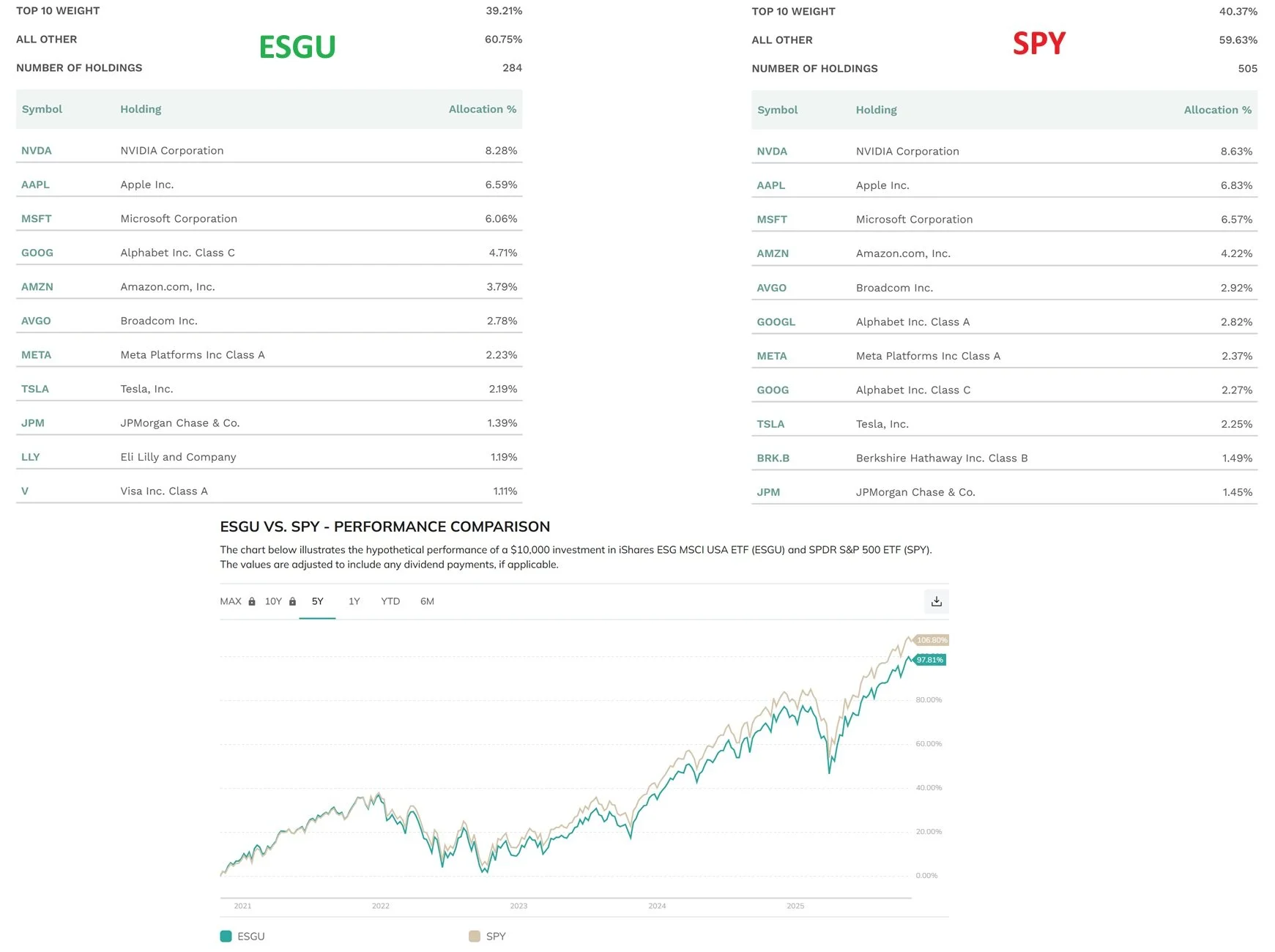

Closet Index Trackers:

Several of the largest ESG funds fail to provide any differentiation vs the S&P 500 itself, despite charging higher fees. Here’s ticker ‘ESGU’, which is the largest “ESG Aware” ETF with 13 billion in assets, vs the S&P 500. Nearly identical top 10 holdings, and 5-year performance:

I believe ESG investing can net investors reasonable returns while accomplishing the feel-good emotional nature of it.

But here are some of the big things to avoid:

1. Greenwashing

"Greenwashing" is a marketing tactic where an investment firm spends more time and money claiming to be "green" or "sustainable" than it does on finding investments that align with their mission.

2. High Investment Expense Fees

Because ESG investing requires extra research, data, and analysis (or at least, that's the claim), these funds often come with higher expense ratios than their non-ESG counterparts. You might ask: Am I just paying a premium for a marketing label?

3. Lousy and Ineffective Screens

This is the most surprising pitfall for many new ESG investors. You might buy an "ESG-screened" fund, only to look at the holdings and find companies you would never expect to see. Inclusive vs exclusive methodology is important to understand. Does your fund exclude dirty companies altogether, or include companies making positive strides? This can explain why holdings vary widely between ESG funds.

So, Is ESG Investing Right for You?

ESG investing is not a magic bullet, it is best viewed as a screen layered on top of a sound financial plan.

Building a portfolio is about managing trade-offs. If this is a path you want to explore, we can help you, as we do for other investors in our ESG portfolio strategies. We can help build a plan that serves your financial goals and your personal values.

Disclaimer: This material is for informational purposes only and not for the purpose of providing, and should not be relied on for, financial, legal, or tax advice. The views expressed herein are subject to change without notice. All investments involve risk, and you may lose money.