So You Want To Be a Doomsday Prophet: Here's How to Start

“The system is collapsing, but I can save you”

Disclaimer: This guide is for satirical purposes only. Following this advice may lead to a loss of friends, family, and actual money, but a potentially massive gain in YouTube subscribers, which is the only metric that truly matters in the coming economic reset.

The allure of being a doomsday prophet is obvious: Potential for instant celebrity + money.

Here’s the how and why:

Fear creates attention (bold calls always attract an audience)

Attention builds authority (fear sells; people are wired to avoid loss, etc)

Authority can be monetized (newsletters, books, investment fund offerings)

Now that we understand why being a doomsday prophet is appealing, we can dive into the playbook of how it works. But first, let’s look at some of today’s leaders in the field:

The Doomsday Prophet Hall of Fame

Haters may call them ‘Financial Charlatans’, but these guys have built an impressive lifestyle predicting an apocalypse, and they all share a similar strategy:

|

|

Medium |

Doomsday Predictions |

End Product |

|

Harry Dent |

Books, Newsletters |

Stock Market Crashes, Demographic Failures |

Dent Sector Fund, Dent Demographics Fund (Closed), Dent Tactical ETF (closed) |

|

Peter Schiff |

Fund Blog, Podcast, Newsletter |

Hyperinflation, Collapse of the Dollar |

Schiff Gold, Euro Pacific Asset Management |

|

Nouriel Roubini |

Professor @ NYU, Books, Newsletter |

Debt/Deficits/Bubbles |

Speaking Appearances, Roubini Macro Associates Consulting |

|

Marc Faber |

“Gloom, Boom and Doom Report Newsletter |

Hyperinflation, Politics, Government Overreach |

Marc Faber LTD Investment Funds |

|

Gerald Celente |

“The Trends Journal” Newsletter |

War, economic collapse, national deficit |

Newsletter, Books, Public Speaking, Consulting |

|

Jim Rickards |

“Strategic Intelligence” Newsletter |

Death of the dollar, economic collapse |

Physical Gold Fund, Physical Hard Assets Fund |

The playbook here is straightforward: Predict a disease, mass distribute it, then sell the cure. We’ll reference these guys throughout the playbook.

7 Steps to Becoming a Prophet of Doom

Step 1: Choose Your Origin Story

No prophet is created without a dramatic conversion story. You can’t just be a person who reads a few blog posts. You must have seen the truth.

The Insider: "I spent 20 years on Wall Street. I saw the rot from the inside. I walked away that day to warn the people."

Rickards worked for Long Term Capital Management (Bankrupt), Schiff worked for Lehman Brothers (Bankrupt). Faber worked for White Weld & Co. (acquired in 1978).

The Scholar: "I was a professor of economic history. While translating an ancient clay tablet, I discovered that culture also had a Federal Reserve that acted too late. Next thing you know, their society collapsed into dust.”

Roubini teaches in the NYU business program.

Step 2: Choose Your Apocalypse and stick with it

Mild predictions aren’t going to cut it. You can’t say “I think the S&P 500 will drop 10% this year” because that happens basically every year, and people aren’t worried about a small drop.

You have to sell TOTAL APOCALYPSE. If you say “the system is about to collapse”, someone will invite you on a podcast to explain. Loss aversion is a powerful instinctive human trait. Your job is to appeal to it.

The “Collapse of the dollar” is a popular narrative. Each of our Hall of Doomers above (Dent, Roubini, Rickards, Schiff, Faber & Celente) makes it a core thesis. Point to the national deficit, government spending, etc, and you’ve got an audience.

The new depression or “great reset” is also a popular one. Take any of the weekly data points and extrapolate away: Unemployment, CPI, PPI, a slowdown in Vegas, etc. Tell them all: “This is the canary in the coal mine.”

Whatever Doom Vision you choose, stick to it. Nobody likes a waffle.

Step 3: Be Confident, master the lingo

To be a prophet, you must sound like one. Share these key phrases and deliver them with grave authority:

"It's not a matter of if, but when."

"The fundamentals are broken."

"A return to the mean is inevitable." (Implying the "mean" is the Stone Age).

"The sheeple are asleep, but the lions are waking up." (Your followers are the lions, obviously).

"This isn’t a prediction, it’s a calculation: a mathematical certainty."

Step 4: Timing is always “soon to very soon”

People don’t care that something might happen “eventually”. If you want their attention, create urgency, and tell them they don’t want to miss the boat. That “boat” being, of course, what you’re selling.

Step 5: Responding to prediction results

If your prophecy coincides with a market drop or recession: Congratulations! You can now advertise this for literal decades. Many of our prophets above take credit for a Japanese stock collapse or internet bubble from 25+ years ago. They proudly advertise those wins to this day, while burying a multitude of losses.

This is the best part of the job (behind the fame/money): Being wrong doesn’t really matter. Don’t people expect you to be right? Not necessarily! Here are some of our Doomer’s worst calls of all time.

Harry Dent

His most prominent bad call of the decade was the "Demographic Cliff" prediction. Around 2011, Dent forecasted that a massive wave of baby boomer retirements would trigger a stock market crash and a prolonged depression, with the Dow Jones falling to as low as 3,000. Instead, the U.S. stock market entered one of the most powerful and sustained bull markets in history.

Peter Schiff

Throughout the entire decade, Schiff's signature bad call was his unwavering prediction of imminent U.S. hyperinflation and a dollar collapse. Starting around 2010, he argued that the Federal Reserve's quantitative easing (QE) was "monetizing the debt" and would destroy the dollar, making gold the only safe asset. The dollar remained the world's primary reserve currency, inflation stayed stubbornly low for the entire decade, and U.S. stocks dramatically outperformed gold.

Nouriel Roubini

While he was more measured than others after his correct 2008 call, Roubini's most notable incorrect forecast was his warning of a "perfect storm" in 2013. He predicted that a combination of a slowdown in China, U.S. fiscal tightening (the "sequester"), and the Eurozone debt crisis would stall the global recovery and could tip the world back into recession. Instead, 2013 became a banner year for the S&P 500, which surged nearly 30% as those fears failed to materialize.

Marc Faber

Faber was consistently bearish on U.S. stocks for years, but a famously bad call came in 2012-2014. He repeatedly warned that the market was a "bubble" created by the Fed and was on the verge of a major crash similar to 1987. In a well-known 2014 interview, he claimed U.S. stocks could easily drop 30-40%, yet the market continued its steady climb for several more years.

Gerald Celente

Celente's most memorable incorrect call of the period was his prediction of the "Panic of 2010." He forecast a widespread economic collapse, food riots, and tax revolts in the United States for that year. While the economy was still recovering, no such panic or societal breakdown occurred, and the market began its long bull run.

Jim Rickards

His most significant incorrect call was detailed in his 2011 book, Currency Wars. Rickards argued that major economies were actively devaluing their currencies to boost their own economies, a process that he predicted would lead to financial chaos and the collapse of the international monetary system. While currency fluctuations continued, the system did not collapse, and his forecast of a catastrophic breakdown proved unfounded during that decade.

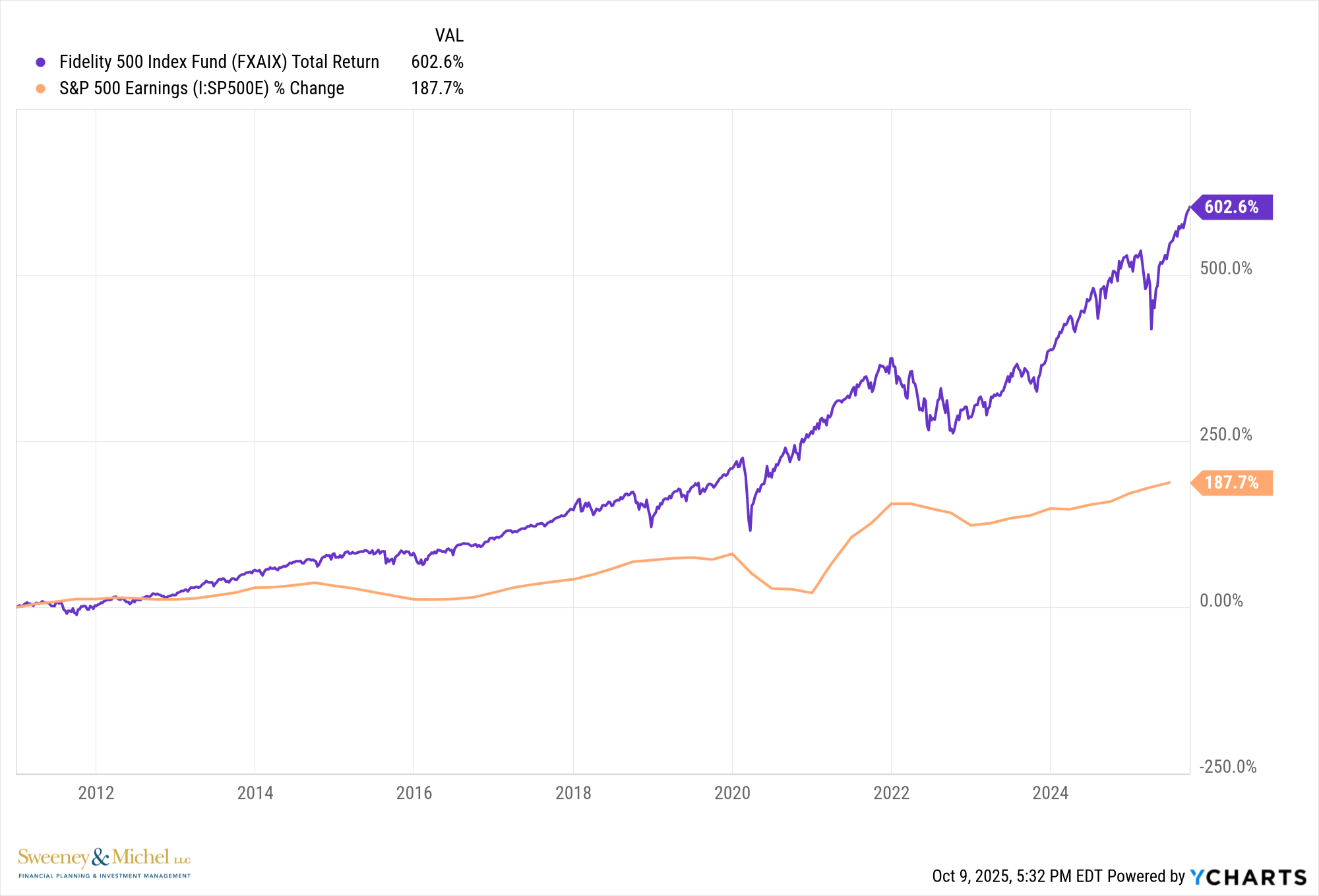

How did these market collapse predictions play out? From the beginning of 2011 to mid-August 2025, the S&P 500 provided a total return of over 600%*. This means that a $10,000 investment made at the start of 2011, with all dividends reinvested, would have grown to roughly $74,500*.

Step 7: you can’t be wrong, only ‘early’

Usually Sometimes doom and gloom predictions don’t go your way. Does that stop our “experts”? No! These “prophets”, still get up every day, claim market/data manipulation, and double down on their warning. “Oh, you thought a 40% drop would be bad? Now it’s going to be a 90% drop!”

Shutter your funds with negative returns, delete the blogs and videos, and bury any evidence of loss. It’s what all the greats do. Only relaunch the new Gold Fund or ETF when you think people forgot about the last failure. Remember, some people want to hear that the world is going to hell in a handbasket. Sell them something!

The economy is vast and full of things to be worried about. You can always find something to publish newsletters and books about.

Pick your apocalypse, polish your rhetoric, and remember the golden rule: if you predict a storm every single day, eventually you'll be right. And you can sell a lot of umbrellas in the meantime.

Disclaimer: This guide is for satirical purposes only. Following this advice may lead to a loss of friends, family, and actual money, but a potentially massive gain in YouTube subscribers, which is the only metric that truly matters in the coming economic reset.

*Footnote: Over Time, Stock Market Returns Tend To Follow Earnings

All investing is subject to risk, including the possible loss of the money you invest. Funds that concentrate on a relatively narrow market sector face the risk of higher share-price volatility. Investments in stocks or bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. An investment in the fund could lose money over short or even long periods. You should expect the fund’s share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market. The fund’s performance could be hurt by:

Stock market risk: The chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising stock prices and periods of falling stock prices. The fund’s target index tracks a subset of the U.S. stock market, which could cause the fund to perform differently from the overall stock market. In addition, the fund’s target index may, at times, become focused in stocks of a particular market sector, which would subject the fund to proportionately higher exposure to the risks of that sector.

Investment style risk: The chance that returns from large-capitalization stocks will trail returns from the overall stock market. Large-cap stocks tend to go through cycles of doing better—or worse—than other segments of the stock market or the stock market in general. These periods have, in the past, lasted for as long as several years.

Sector risk: The chance that significant problems will affect a particular sector, or that returns from that sector will trail returns from the overall stock market. Daily fluctuations in specific market sectors are often more extreme or volatile than fluctuations in the overall market. Because a significant portion of the fund’s assets are in the information technology sector, the fund’s performance is impacted by the general condition of that sector. Companies in the information technology sector could be affected by, among other things, overall economic conditions, short product cycles, rapid obsolescence of products, competition, and government regulation.

Nondiversification risk: Because the fund seeks to closely track the composition of the fund's target index, from time to time, more than 25% of the fund's total assets may be invested in issuers representing more than 5% of the fund's total assets due to an index rebalance or market movement, which would result in the fund being nondiversified under the Investment Company Act of 1940. The fund’s performance may be hurt disproportionately by the poor performance of relatively few stocks, or even a single stock, and the fund’s shares may experience significant fluctuations in value.

Index-related risks: The fund is subject to risks associated with index investing, which include passive management risk, tracking error risk, and index provider risk. Passive management risk is the chance that the fund's use of an indexing strategy will negatively impact the fund's performance. Because the fund seeks to track the performance of its target index regardless of how that index is performing, the fund's performance may be lower than it would be if the fund were actively managed. Tracking error risk is the chance that the fund's performance will deviate from the performance of its target index. Tracking error risk may be heightened during times of increased market volatility or under other unusual market conditions. Index provider risk is the chance that the fund will be negatively impacted by changes or errors made by the index provider. Any gains, losses, or costs associated with or resulting from an error made by the index provider will generally be borne by the fund and, as a result, the fund's shareholders.

Index replicating risk. The chance that the fund may be prevented from holding one or more securities in the same proportion as in its target index.