🫧Bubble Territory 🫧

Gemini ($20/mo. Generative AI subscription) effortlessly updated this picture of kids from the Sweeney & Michel Luau. Google’s spent nearly $100 billion on AI this year alone.

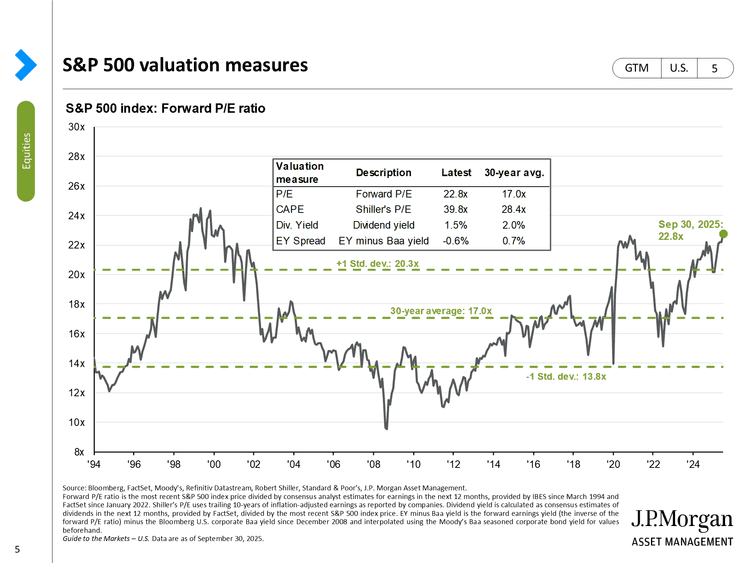

How long can this melt-up in AI/Quantum/Cloud stock valuations continue?

This week was our quarterly investment committee meeting, where we assessed risk-reward opportunities in the markets. Stretched stock market valuations were the top subject.

Here’s the thing: predicting investment bubbles is pretty easy.

New technology

+ Promises for the future

= Investors rushing into the stocks.

Predicting when the bubble pops is the hard part. Commentators on CNBC seem to have no issue acknowledging this market feels similar to the dot-com bubble… but disagree on how long it has left. “We’re in the early innings of AI,” they say. In our experience, when pundits start pulling baseball analogies, we’re usually in the 7th inning stretch.

Our skepticism centers on how quickly these AI Tools can generate profits that exceed the current spend.

New AI deal announcements happen weekly, but few make fiscal sense once you get beyond the headline. For example:

Last week the news was “OpenAI is taking a 10% stake in chipmaker AMD”.

AMD’s stock rallied 40%.

The deal details paint another picture: OpenAI has $17 billion in cash, plans on losing half of that this year alone. AMD was worth about $200 billion pre-announcement. Where is the investment money going to come from? How is that going to work? Turns out AMD has agreed to sell them chips and give Open AI them 160 million shares to pay for it. How’s that for creative accounting?

And there’s always Sam Altman’s quote from 2019:

We have never made any revenue. We have no current plans to make revenue. We have no idea how we may one day generate revenue. We have made a soft promise to investors that once we’ve built this sort of generally intelligent system, basically, we will ask it to figure out a way to generate an investment return for you. -Sam Altman with StrictlyVC 2019

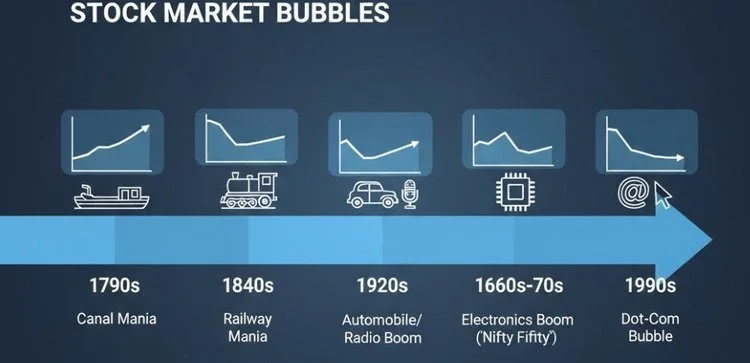

There are certainly people smarter than us who believe AI is going to change the world. It probably will! But we are junior market historians, and history shows every new tech arrival comes with a bubble. You almost can’t have real-world innovation without one.

Enthusiasm often arrives long before the profits: Railroads, automobiles, and the internet have all dramatically changed the world, yet only a handful of companies and stocks have survived along the way. Webvan, Pets.com, and EToys didn’t make it, but Amazon did. They can’t all be winners.

If the expression “this time is different” are the 4 most dangerous words in investing, then “This too shall pass” might be the most timeless. We’ve seen market cycles move too many times.

In Summary:

We’re more cautious around businesses with high valuations and are committed to rebalancing and diversifying portfolios. This means reallocating some of the tech-sector exposure to international stocks, which have shown momentum for the first time in a decade. For new deposits and purchases, we’re looking at short-term treasuries, limit buys on high-quality stocks.

Investors can make a lot of money by capturing 80% of the returns between the lows and the highs. It’s holding out for the last 10% that gets you in trouble.

Predicting short-term market moves is impossible. We know this, which is why we never made dramatic changes or ever bet against a sector.

-One scenario is that the AI party continues for a couple more years; our remaining equity should continue to do well

-We diversify and rebalance for the other scenario.