How to Survive The Emotional Stress of a Market Freefall

What a month it’s been.

By now you know fears of a Pandemic from CoronaVirus are sweeping the globe and impacting travel, social gatherings and markets. Stocks are down roughly 20% from their highs (oil/airlines/cruises are down far more). We know that market pullbacks are a normal occurrence for the stock market- indeed, there wouldn’t be rewards without risk.

During these steep drops it’s normal to feel fear, but not ok to act on it. Below is some perspective on what we think investors should be focusing on right now.

If you have a goals-based portfolio, the investment strategy should account for seasons like this. Unless yours goals have changed, your investments probably shouldn’t either.

Remember- market drops are a normal occurrence every year. However, most years or following years are met with gains for the patient.

While it’s tempting to sell everything and “wait for the dust to settle”, missing even a couple rebound days can permanently impair your long term returns. Besides, markets usually rebound long before headlines do. No one will ring a bell when the market is done dropping.

With bond yields dropping, stocks have very little competition from “safe” assets. The days of selling stocks to buy 4-5% bonds appear to be behind us. Investors who need income simply won’t find very much of it from bonds and money market funds.

It’s rare, but stocks now have a higher current yield along with a higher expected return.

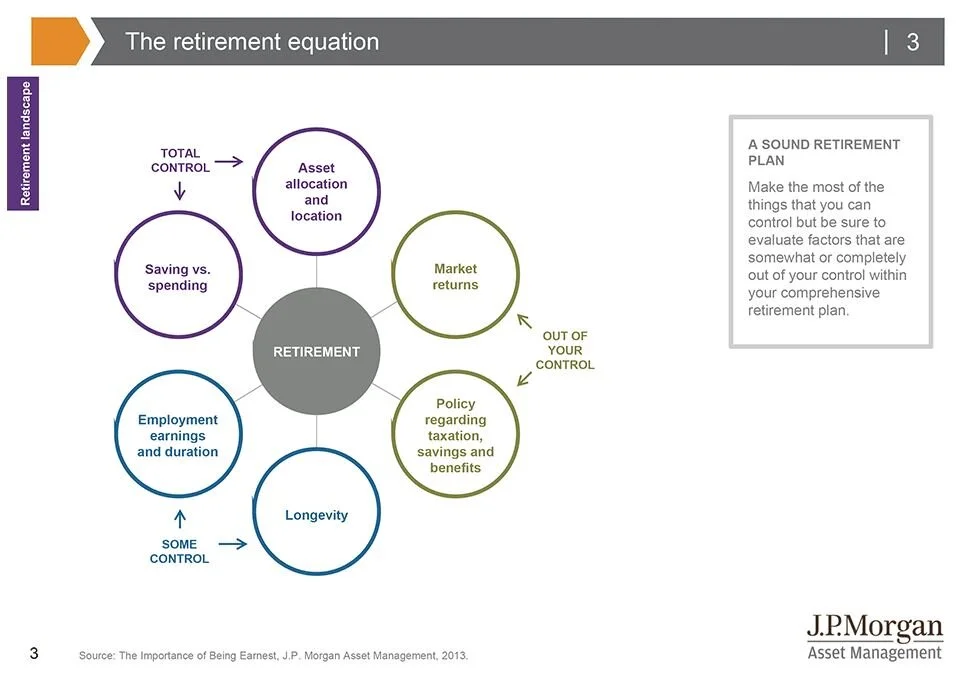

While markets are out of our control, it’s best to focus on things we can. Saving more, adjusting your asset allocation or spending less.

If you’re young, you should be enjoying pullbacks. Lower prices make for better entry points.

However, even if you’re retired, you probably still have a long term investment horizon. There’s a 75% chance a married couple at age 65 will see one spouse live for another 20 years.

Now may be a good time to review your investment strategy to make sure it’s aligned with your goals. Markets can be scary, but what’s important isn’t where they’ll be tomorrow. It’s where they’ll be over the next 5/10/20 years when you’re living on the income.

As always, please reach out with any questions you have. If You’d like to schedule an appointment with us, You can call us at (530) 487-1777 or BOOK ONE ONLINE HERE