If you only used this chart, you could make a good argument for investing when the fear index is above 30:

Keep readingHere’s what we’re telling clients about the Tariffs:

Keep readingTo understand where things are going, it’s important to remember where we’ve been. Consider the products and services that didn’t exist 25 years ago:

iPhone

Amazon Prime

Facebook

Youtube/Gmail/Google Maps/Chrome

Notes on the rotation out of tech, and our latest video with charts of the moment

Keep readingIf you’re planning for retirement, knowing the milestones is essential to avoiding taxes, penalties and missed opportunities.

Keep readingNotes and Outlook on Wildfires, Insurance, AI, Biotech and Tax Reform

Keep readingIf you’re wondering what your top 2025 California and Federal taxes rates are, look no further.

Keep readingWhat’s most important about this exercise (aside from internal bragging rights) is to honestly assess where markets are at. Under scrutiny, investment opportunities tend to look more or less attractive, never the same. A true time to divide what’s bullish and what’s bull$h!t.

Keep readingA Required Minimum Distribution (RMD) is the minimum annual amount you must withdraw from pre-tax retirement accounts like IRA’s and 401(k)’s. Here’s what you need to know:

Keep readingIn 1982, American Biologist E.O. Wilson wrote “We are drowning in information, while starving for wisdom”. That’s truer than ever today:

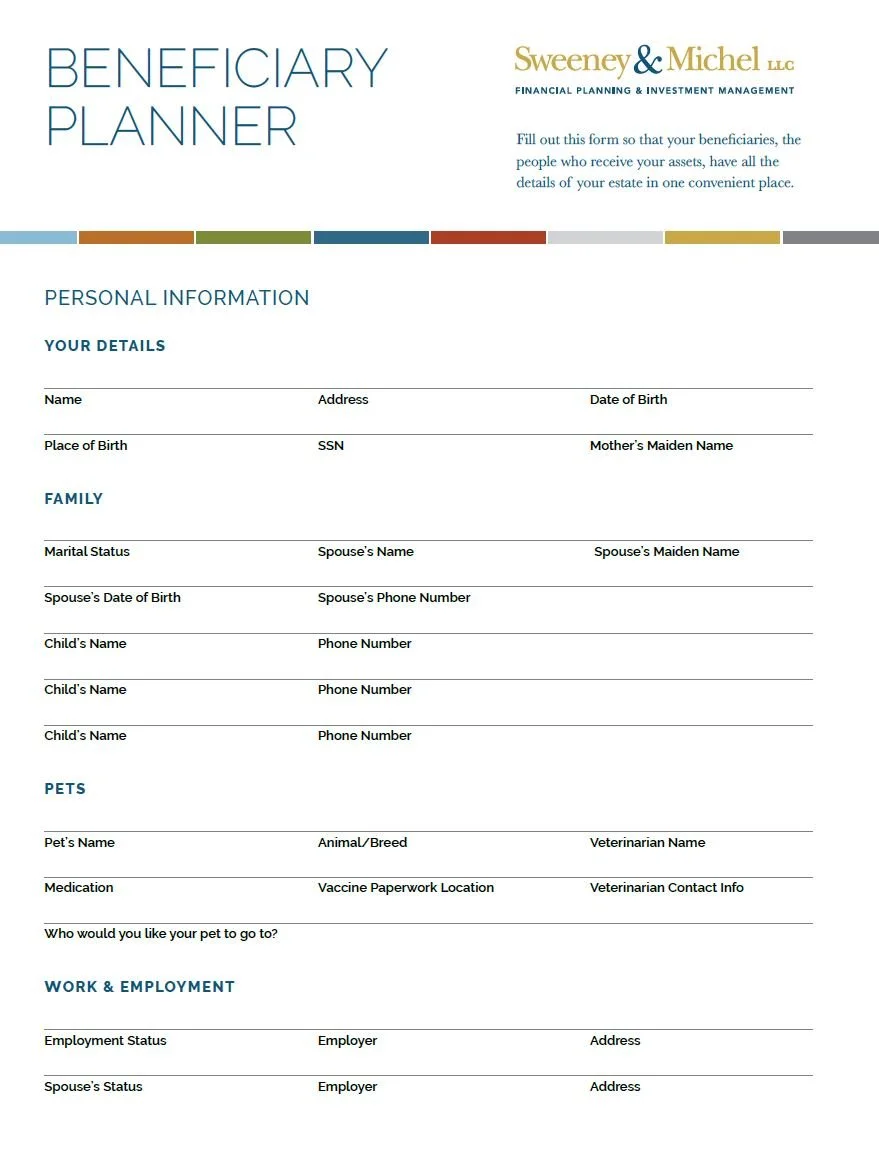

Keep readingDo you ever worry about who will help manage your assets and affairs should your family be struck with death or incapacitation? Have you thought about consolidating everyone’s contact information on a single document?

Keep readingThere are several possibilities, but here are the strongest ones (in our opinion)

Keep readingAmericans may be looking forward to the end of a tumultuous political campaign season. However, if past trends are any indication, 5 November could be just the beginning:

Keep readingNot only do the top 10 companies struggle to keep growing at the same rate, but most of their investment returns underperform the market itself:

Keep readingAs many of our clients know, we clear our calendar to meet every quarter to review client portfolios, economic developments, and potential market impacts. Here are some notes from our latest meeting:

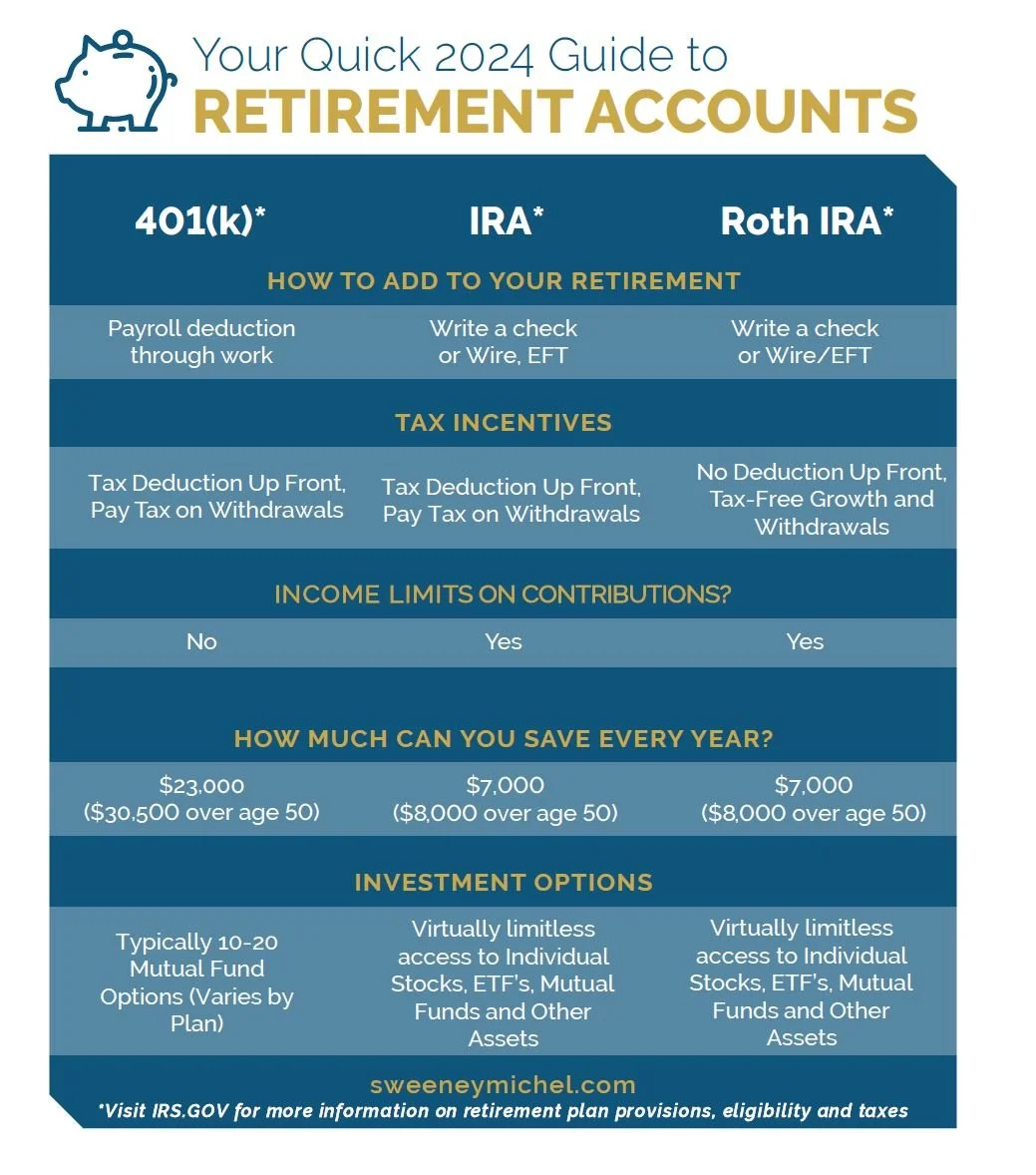

Keep readingOur 10 second guide to retirement plans in 2024:

Keep reading9 Key Takeaways from Our 40 Minutes on Markets, Wars and Outside Risks

Keep readingHere are 4 ways your account is protected

Keep readingGoing back to 1928, September is the worst month, on average, for market returns. Here's what's happened in the following months:

Keep reading